🧭 Introduction

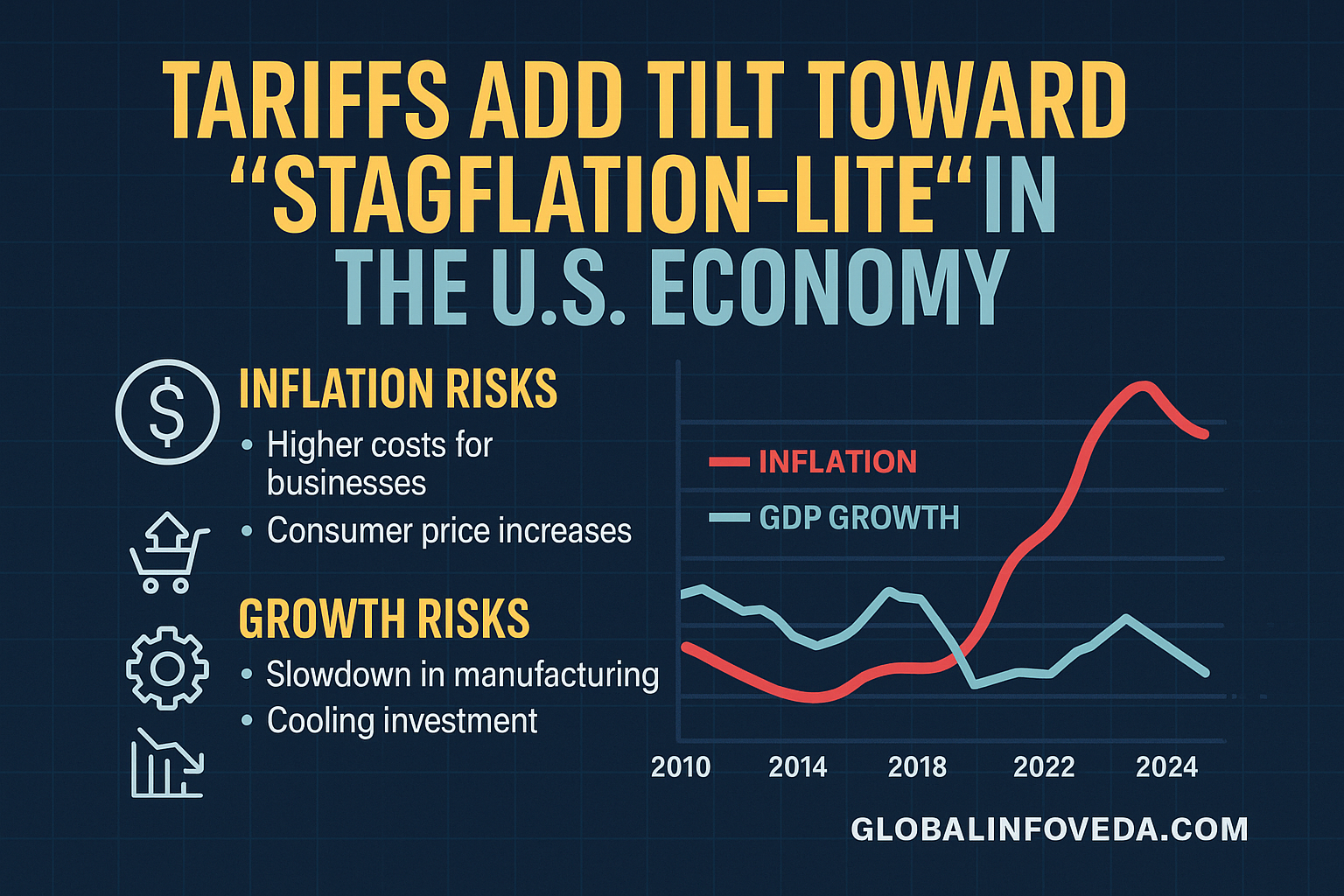

Stagflation-Lite: The reinstatement of sweeping tariffs in 2025 has not been followed by a 1970s rerun, but it has put the United States in a stickier mix to which many economists now refer as “stagflation‑lite.” And for more than a decade, the growth has been lower than it would have been, consumer prices have consistently run above wage gains for the basic baskets people need, businesses are reporting ongoing cost‑push pressures even in the face of uneven demand. This is not the bottom falling out; it’s more like a sobbing grind. The friction materializes in checkout lanes, small‑business purchase orders and municipal budgets that must do more with less. In this comprehensive guide, we explain how trade duties ripple through supply chains, how they are enmeshed with monetary policy and what households, employers, retailers and lawmakers can do to stop the temporary shock from sticking around as a two‑year habit. You’ll also find, side by side, tables, maps, examples of sectors and an action kit that will put a focus on practical saving far over ideology.

Meta description: Why 2025 tariffs are nudging the U.S. toward stagflation‑lite—with sector impacts, scenarios, and playbooks for budgets, businesses, and policy.

🧩 What exactly is “stagflation‑lite” in 2025?

Stagflation-lite is a time when inflation stays higher than comfort, but growth slows below potential — except without the outright recessional job losses of classic stagflation. Think core goods prices that simply stop falling, services that creep up on input costs and wages, and firms that are reluctant to invest because policy feels unpredictable. Tariffs are central to the 2025 model: they raise the landed cost of high-value-added finished goods and key ingredients, delay port dwell times, and trigger costly rewrites of rules-of-origin documentation. And the result is a slow squeeze, not a jolt. Families put off buying replacements, small companies cut back on stocking their shelves, and communities delay maintenance. For the reason that expectations adjust rapidly in consumer‑facing categories, the risk is that temporary costs harden as new price norms. Around that future lie discipline at the checkout (unit‑price literacy), loading docks (assortment rationalization) and capitals (time‑boxed measures with sunset clauses) or no future at all.

🔧 How tariffs travel through the economy

- 🛃 Border cost jump: Tariffs raise the invoice on finished goods and critical parts the moment they clear the port, making list‑price hikes or pack changes more likely.

- 🧱 Compliance friction: New rules‑of‑origin, labeling, and testing add non‑price hurdles that slow the supply chain and raise carrying costs for importers.

- 🚚 Logistics spillover: Rerouting to new supplier hubs changes sailing times, chassis availability, and warehousing—embedding higher freight into base costs.

- 🏷️ Shelf strategy shifts: Retailers protect key price pegs by trimming features or promotions, while expanding private‑label where they control specs.

- 🧰 Services lag: Clinics, salons, and repair shops pay more for imported consumables and equipment, adjusting fees months after the goods shock.

- 🧠 Expectation anchoring: Households internalize the new normal, which can cement inflation expectations even if wholesale costs ease later.

Extended consumer lens: U.S. Families Could Pay $3,800 More a Year Due to Tariffs

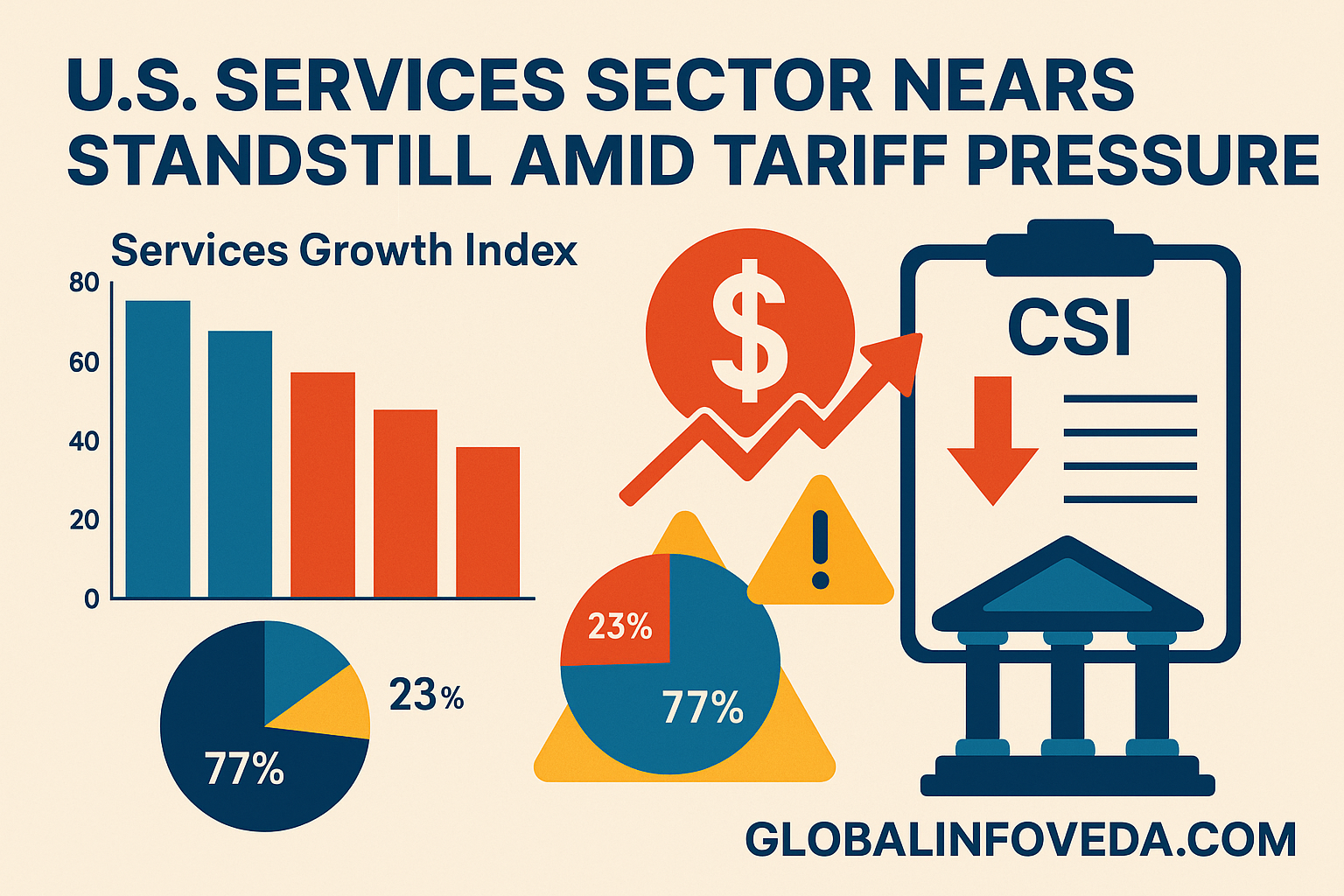

🧮 Evidence you can see in 2025

The telltales of stagflation‑lite are strewn but readable. Core goods quit delivering deflation offsets; entry‑tier apparel, small appliances, and auto parts drift up even as overall demand remains soft. Services inflation lags and then cranks — particularly where imported inputs matter — dental supplies, salon gear, diagnostic tools. Now retailer earnings calls speak less of “demand headwinds” and more of container fill, carton engineering and OTIF (on‑time‑in‑full) improvements to claw back cents. (GfK) Households are reporting smaller baskets of goods, more private‑label purchases, and a delay in replacements. Small manufacturers tell me windows of quote validity have shrunk from 90 days to 30, a symptom of supplier unease. None of this screams crisis. It does murmursome survival: a year of heightened cost‑to‑serve that should challenge process excellence and budgeting muscles throughout the economy.

🧺 Household reality under stagflation‑lite

- 🧾 Groceries: Imported oils and canned goods creep up; refill formats and store brands hold the line.

- 🧰 Home repair: Parts and fixtures rise; maintenance sprints beat emergency replacements.

- 📱 Electronics: Duties on boards and batteries flow into tags; certified refurb with long OS support stretches cycles.

- 👟 Apparel/Footwear: Entry pegs wobble first; quality matters more than novelty trims.

- 🚗 Mobility: Tires and brake kits outpace fuel; alignment and rotations save multiples.

- 🧒 School tech: Accessories and spares cost more; pooled procurement and buy‑backs stabilize.

Human impact angle: Working‑Class U.S. Families Hit Hardest by Tariff Anxiety 2025

🏭 Small‑business operating math when costs won’t sit still

For small and medium-sized businesses, tariffs rewire cash conversion cycles. Suppliers’ deposits with firms climb with landed cost, and bank APR on credit lines rises so that working capital is compressed. Quote windows compress; clients demand fixed prices even as inputs see-saw. The cure is operational—not heroic. Prune SKUs, deepen the rest and publish spec cards so customers know what you are protecting. Use milk runs to reduce damage and demurrage. Hedge FX in layers, not bets. Offer service packages (filters, belts etc). Whilst discounting finished goods costs your customer, the prevention of breakdowns saves them money. Most important, tether promos to fixed windows when customers plan — not surprise fire sales that train them to hold out for chaos.

🧠 Monetary policy’s dilemma in a tariff year

Central banks hate supply‑side inflation because raising rates barely even gets you there, and risks choking off growth. But allowing inflation expectations to drift would be even worse. In 2025, the trade shock demands a refined choreography: keep policy tight enough to prevent a wage‑price spiral from forming, while conveying that tariff shocks are one‑offs that should not shape multi‑year contracting. Communication does real work here, not just rates, which is why certain categories may remain stubborn for months and why patience is better than panic. If officials combine that guidance with information about port dwell times, inspection holds and standards fast‑tracks, businesses believe that the shock is managed, not random.

🧮 📊 Side‑by‑side—classic stagflation vs stagflation‑lite vs soft landing

| 🧭 Feature | 🪨 Classic stagflation | 🌤️ Stagflation‑lite / 2025 |

|---|---|---|

| Inflation profile | Broad, double‑digit; energy‑led and persistent | Elevated core goods and lagged services; mid‑single digits |

| Growth & jobs | Recession, rising unemployment | Slower growth; jobs hold but hours/OT compress |

| Policy stance | Aggressive hikes; fiscal squeezes | Tight but communicative; targeted relief/standards diplomacy |

🧠 Sector snapshots—who feels it most, who adapts fastest

Auto aftermarket takes the hit from tariffs on tires, brake kits, sensors; co‑ops and pooled buys blunt the pain. Appliances and electronics get bumped to spec to defend entry stakes; warranty and repairability become selling points. Later on, healthcare fees are increased, which are related to disposables and equipment that is imported. Reliability favors maintenance over growth; and construction, costlier fixtures and small motors. Consumer packaged goods: Expanding private‑label and refill aisles. Restaurants lean on dynamic pricing and shrink menus to maintain gross margins. Winning is operators who tell customers exactly what’s changed and why — transparency turns anxiety into loyalty.

Market plumbing: Global Realignment—Tariff Wars Fuel Decoupling of Financial Systems

🧪 Case studies across the chain

- 🛒 Regional grocer: Refused stealth shrink; redesigned cartons and routes to lift container fill by 7%. Published spec cards for oils and rice; entry pegs held, churn fell.

- 🧰 Repair co‑op: Independent mechanics pooled parts buys, standardized diagnostics photos, and offered rotation bundles. Households saved; shops kept volume without race‑to‑the‑bottom pricing.

- 🧪 Mid‑cap manufacturer: Cut SKUs 30%, doubled order depth, swapped to standard fasteners, and layered FX hedges. Quote validity rose from 21 to 45 days; backlog cleared faster.

🧭 Regional patterns that shape pass‑through

- 🌉 West Coast: Import‑heavy baskets move fastest with port shifts; private‑label adoption surges.

- 🗽 Northeast: Apparel and home goods feel the duties; transit blunts fuel sensitivity; refurb electronics grow.

- 🌵 Texas/Sunbelt: Car‑heavy; tires and brake kits dominate; DIY and tool‑lending show outsized gains.

- 🌽 Midwest: Less food pass‑through; more appliance/auto parts pain; repair co‑ops thrive.

- 🏔️ Mountain states: Outdoor gear exposure; off‑season buys and consignment swaps help.

🧠 Why expectations matter more than spreadsheets

Inflation is partly psychology. If consumers believe tariffs are here to stay, they more quickly accept higher consumer prices and stop shopping for value. Which is why retailer disclosure of pack size, materials, and warranty details alters outcomes. The skeptical buyer is made into a partner by publishing a one‑page explanation of what we changed, and why we defended what we chose to keep. On the policy side, time‑boxed measures with clear sunsets are used to keep markups from becoming mummified into a new floor. The sooner stakeholders see an exit ramp, the less likely they are to bake in permanent padding to their models.

🧰 Household action kit for a sticky‑cost year

- 🗓️ Calendar big buys to anchored promo windows; panic purchases are the most expensive.

- 🔧 Maintenance sprints: filters, seals, wipers, tires; avoid the failure premium.

- 🧴 Refill culture: bulk where quality is proven to cut per‑use cost.

- 📏 Unit‑price literacy: track a handful of staples; reward honest packs.

- 📱 Certified refurb: longer OS support and standard ports beat cheap‑new.

- 🧰 Repair networks: ask for photo‑documented diagnoses to avoid upsells.

Practical cost defense: Who Wins? How U.S. Tariffs May Backfire on USA Consumers

🧮 Scenario map for the next 12 months

- 🔵 Base case: Tariffs stay elevated but predictable; retailers deepen private‑label and specs are transparent; services creep up then settle. Response: pull forward maintenance, time replacements.

- 🟢 Upside: Targeted TRQs on staples, standards diplomacy, faster port clearance; select categories roll back. Response: execute dormant replacements; lock service contracts.

- 🔴 Downside: Fresh trade flare‑ups, FX swings, and longer port dwell; services reset higher. Response: freeze discretionary bucket; double down on repair/refill.

🧮 📈 Side‑by‑side—policy tools and likely price effects

| 🧰 Tool | 🎯 Goal | 🧾 Likely effect on tags |

|---|---|---|

| Tariff‑rate quotas (TRQs) | Cap consumer incidence on essentials | Stabilizes oils, grains, dairy prices |

| Standards fast‑track | Speed compliant goods through ports | Fewer stock‑outs; less just‑in‑case padding |

| Port dwell dashboards | Expose friction costs in real time | Shorter waits; more predictable delivery windows |

🧠 The monetary‑fiscal handshake that avoids hard landings

In stagflation‑lite macro prudence is ballet. Monetary policy does keep the anchor — rates at a level tight enough to prevent wage spirals — and fiscal and trade arms operate surgically where the incidence is highest. That includes short-term TRQs on staples, receivable-insurance support for small importers, and city-level tool-lending and repair cultures. If it is a boringly predictable one, then the handshake is effective; anything else and it is a hidden tax the family or SME always ultimately ends up paying.

🔍 Corporate playbook to protect value without stealth shrink

- 🧾 Entry‑tier integrity: guard net quantities and publish spec cards.

- 📦 Assortment trims: fewer, deeper SKUs drive leverage and reliability.

- 🚚 Milk‑run logistics: clustered pickups reduce damage; measure OTIF.

- 🧪 Audit cadence: clear replacement suppliers in weeks, not quarters.

- 🧰 Service bundles: preventative parts plus reminders drive real customer savings.

- 🛡️ Warranty clarity: simple, longer coverage beats flashy features.

🧠 Investor lens—how to separate signal from noise

Investors should expect margin compression where firms failed to redesign operations. The green flags: stable gross margins with flat or rising container fill; falling damage returns; lower inspection hold rates; and honest spec communication that keeps churn low. Red flags: stealth shrink, confused promo calendars, and widening days‑inventory‑outstanding. In a tariff cycle, operational excellence is the moat; storytelling without carton math will not hold.

🧪 Timeline of pass‑through—why patience matters

The transition from tariffs to tags is halting. Finished goods move first — clothing, small electrics — then, the inputs that service providers use, and, finally, wages where there are still shortages. The entire arc takes 6–18 months or so, depending on the contracts and on port realities. That is why time‑boxed, published milestones for policy can be helpful: firms don’t perceive relief terms as dated, so they resist over‑correcting with permanent pricing ladders. 58) Households that front‑load maintenance ride out the mid‑curve with fewer emergencies.

🧠 Myths that keep prices high

- 🧨 “Everything’s up, timing is pointless.” → Anchored promo windows still matter; plan big buys.

- 🧴 “Store brands are low quality.” → Many private‑label items share plants with national brands; specs tell the truth.

- 🛠️ “Repairs are sunk costs.” → In a tariff year, maintenance is the best ROI.

- 📦 “Shrinkflation is unavoidable.” → Vote for honest packs; retailers track defections closely.

🧠 FAQs

Does buying American‑made avoid all tariff effects? No. Many goods contain imported components. Focus on repairability, warranty, and honest specs.

Will prices fall the moment tariffs pause? Some will, but contracts and friction costs can keep tags sticky. Transparency on port dwell and TRQs speeds normalization.

Are warehouse clubs always cheaper? Often, but unit‑price and expiry controls still rule. Buy what you’ll use.

Is gold a household hedge in stagflation‑lite? Gold ETFs can smooth portfolios, but for budgets, maintenance and energy‑efficiency give faster, certain savings.

🧮 📊 Side‑by‑side—household types, exposure, best first move

| 👪 Household | 🎯 Exposure hot‑spot | 🧰 Best first move |

|---|---|---|

| Two‑kids suburban | Electronics and auto parts | Maintenance sprint; certified refurb devices |

| Single urban | Groceries and services | Private‑label pivot; loyalty programs |

| Senior couple | Health equipment and utilities | Energy‑efficiency kits; service contracts |

🧠 Personal analysis—how to keep “lite” from becoming “heavy”

The key to keeping stagflation‑lite from hardening is predictability. If households can plan around clear promo calendars, if retailers defend the entry tier with transparent spec cards, and if policymakers publish port and standards metrics while time‑boxing duties, then behavior adapts in the right direction. People invest in upkeep, firms invest in carton and route math, and expectations slip back to normal as frictions ease. The moment we treat tariffs as permanent and open‑ended, everyone pads—budgets, quotes, and wages—and the “lite” becomes heavy. Discipline, not drama, is the difference.

Policy pathways and tradeoffs: Retaliation or Diplomacy: What India Can Do Amid Rising U.S. Tariffs

🧾 Price formation inside a retailer’s P&L—why small frictions look big at checkout

During a cycle of tariffs, a retailer’s cost-to-serve is transformed in about three dozen small ways that combine to keep consumer prices intractable. The landed cost inflates on the dock, financing costs build as goods linger, port dwell and inspection holds extract from working capital, carton redesigns and reroutes necessitate re‑ticketing labor, and warranty reserves balloon when suppliers confronting duties cut the quality of the parts they provide. None of these would explain a 4–7% tag move, but together they might. The defense is process: simplified assortments make for deeper buys, gains on container fill from better carton specs, pooled milk‑run logistics, and honest spec cards and slotting fees that enable retailers to maintain entry‑tier integrity without stealth shrink. By explaining this arithmetic on the shop floor and at scale, retailers earn loyalty instead of embarrassment, and the long tail of operational improvement, which is less sexy, finally shows up in the form of lower tags.

🧭 Governor & mayor toolkit—city‑level moves for a sticky‑cost year

- 🗺️ Price‑integrity dashboards for municipal markets that spotlight honest net quantities and stable pegs.

- 🧰 Repair fairs and tool libraries so renters can fix fixtures without predatory call‑out fees.

- 🚍 Transit flash passes during peak auto parts spikes to relieve commuting budgets.

- 🧪 Standards fast‑track cells that coordinate with federal agencies to clear compliant goods quickly.

- 🧊 Cold‑chain resilience grants for food banks and small grocers; fewer spoilage losses mean lower community prices.

- ♻️ Refill corridors in neighborhood retail, backed by small signage funds and scale pricing from wholesalers.

🏫 School districts & clinics—how public services hedge stagflation‑lite

Public institutions experience tariffs as quietly as households do. Even when imported boards carry duties, a school system that standardizes on long‑OS‑update devices, common chargers, and a buy‑back lane is reducing per‑student tech cost. (not enough devices even if supply miraculously could penetrate so it can be autoclaved) community clinics 1) that post sterile supply fees 2) source refurb equipment with warranties, to hold the costs down as imported disposables rise. Both can negotiate aggregated deliveries with milk‑run carriers shared across agencies, reducing damage and demurrage. The soft benefit is predictability: parents and patients do better when surrounding institutions sign on to lay their specs on the table, with multi‑year support — precisely the behavior that defuses inflation expectations.

🔍 Pricing power along the income ladder

Tariffs don’t strike evenly. More fortunate households can front‑load purchases into an anchored promo, make energy‑efficient upgrades, and access low‑APR credit that allows them to arbitrage consumer prices over time. and workingstiff homes are more likely the ones who are going to find themselves being outsourced to an entrylevel category that is most open to quiet degradation of pack sizes, materials, and length of warranty. That’s why private‑label with published spec cards is so powerful in 2025: it restores parity by allowing lower‑income shoppers to see what they’re getting, and punishing stealth shrink. Over the course of the year, communities that invest in repair culture — co‑ops, tool libraries, refill stations — tilt the playing field back toward those who don’t have the luxury of waiting.

📣 Retail communication scripts that lower anxiety (and returns)

- 🧾 “What we changed, what we defended” cards at the shelf: materials, net quantity, warranty, and why.

- 🧪 Quality receipts: QR to lab tests for private‑label staples (oils, grains) that shoppers worry about.

- 🛠️ Preventive bundles: filters, belts, batteries promoted with clear install windows.

- 🧰 Repair pathways: signage to local shops and warranty claim steps so customers repair before replacing.

- 🧭 Promo calendars: posted windows (back‑to‑school, holiday) so families can align spend.

🛰️ Forecasting with AI when trade rules shift

When rules‑ of‑origin and landed costs shift, historical demand curves can deceive purchasers. Teams of forecasters combining short-horizon machine learning with human merchandising judgment outperform black-box volume guesses. The most advanced practice is a two‑track system: one model for base demand by store and week, and another for elasticity around pro-tected pegs and private‑label substitutes. Feed both with live port and freight data so that the models “see” dwell time and chassis shortages that will arrive on shelves in 6–10 weeks. AI that can comprehend cartons, not just clicks, is the edge in stagflation‑lite — and a reason operational data (fill rates, OTIF, damage) should be found in the same room as the marketing.

⛽ Energy & commodities—the feedback loops that fool shoppers

Tariffs, families may assume, are about gadgets and clothes, yet the spillovers echo through diesel, steel, aluminum and packaging resins. A longer shipping route drives bunker fuel demand, ratcheting freight indexes higher; a thoroughgoing inspection regime unbalances reefer availability, quietly pricing produce up; and a swing in FX against supplier currencies materializes months later as bizarre spikes in canned goods. The smart response isn’t doom but substitution: refill formats for cleaning and personal care, frozen for some vegetables when cold‑chain pressure is visible, delayed replacements until cost‑to‑serve metrics relax. Households that go down these loops read — often through retailer disclosure — are saving real money without diminishing quality of life.

🏗️ Industrial policy trade‑offs—friend‑shoring with eyes open

Relocate supply from high‑duty lanes to friend‑shored hubs for reliability, but the first mile (or first 5 miles or first 10 miles) costs more money. New suppliers need to pass audits, redo tooling, and come up to speed on packouts that optimize the container fill — while volumes remain very unclear. Governments’ greatest contribution is to fund audits and release template standards that accelerate vendor onboarding. Firms do themselves a favour by slashing SKUs so supplier launches land with scale. The real world works backwards: Over 18-24 months, the reliability premium exceeds the initial price lift — but only if customers don’t pad specs and instead pursue boring excellence — milk runs, carton math, and clear warranties — rather than dramatic “resilience” announcements.

🧮 Household playbook—turning averages into savings

- 🗓️ Pre‑commit one shopping day and one maintenance day weekly; routine beats panic.

- 🔧 Run a 12‑week maintenance cycle (filters, seals, wipers, oils) to block the failure premium.

- 🧴 Adopt two refill categories (cleaners, soaps) first; expand once quality is proven.

- 📏 Track five staples for unit price and net quantity; adjust when specs slip.

- 📱 Choose certified refurb with two‑year warranties for devices; prioritize long OS support.

- 🧰 Map repair shops and ask for photo diagnostics; reward those who explain clearly.

🌍 Currency swings—what they mean for households

Even if a tariff doesn’t change, FX moves change the math on imports. A stronger dollar can soften landed costs; a weaker one magnifies them. Households don’t have to play the currency markets to profit — they have to time their purchases. If retailers issue a pithy note that a category’s FX tailwind is coming to an end (i.e., electronics models recirculating through a period of promotion), households can pull future buys forward on the calendar. If FX does go bid, households stay at maintenance and refill rates and wait for the next anchored window. At aisle level, transparency turns macro noise into marketable signals.

🧑⚖️ Labeling, unit pricing, and why rules matter in 2025

In times when consumer prices move quickly, trust is all about the small labeling decisions. Clear unit pricing, visible net quantities and unambiguous warranty statements matter more in stagflation‑lite than in placider years, because when shoppers are hunting for anchors. Regulators can keep grievance levels low by auditing to a category circumstance level (oils, canned goods, small electrics) status rather than a minimum, and retailers that go beyond the minimum — spec cards, pack changes disclosed — engender loyalty instead of suspicion. In a tariff year, communication is the friend of enforcement — the more light on specs, the less oxygen for rumor.

📈 KPIs to watch—signals that the tilt is easing

- 📦 Container fill rising and damage returns falling—carton math is working.

- ⏱️ Port dwell median trending down—friction costs are abating.

- 🧾 Private‑label share up with flat complaint rates—value without quality slippage.

- 🧰 Repair network throughput rising—households choosing fixes over panic replacements.

- 🏷️ Entry‑tier pegs stable through two promo cycles—retail discipline is holding.

🧭 Operator’s notebook—why boring excellence beats flashy fixes

In stagflation‑lite, heroes are traders and doers who re‑do cartons, not tag lines; who bankrupt SKUs, not disclose “innovation days”; who fax spec cards and throw in entry‑tier warranties instead of filling a shelf with a look‑alike. Each percentage point of added container fill, each day of trimmed port delay, each honest promo window posted are all literal value delivery to families. The compounding is literal: less damage, fewer returns, fewer emergency replacements. That’s how a system emerges from a year of not hitting families up to take on a higher cost of living forever.

🧭 What to expect next—12–18 month arc beyond 2025

So long as tariffs plateau and standards pathways mature, the U.S. might exit stagflation‑lite through consistent goods disinflation and normalized services fees (after clinics and salons are forced to digest their input resets). The quickest path is coordination: importers communicate dwell data; ports post holds; agencies anticipate time‑boxing of TRQs; retailers enforce entry‑tier integrity; and households maintain the maintenance/refill habit rather than snap back to discretionary waste. Anticipate 1–2 quarters when tags are sticky even as upstream costs fade — that’s contracts catching up. Patience pays off in the second half: categories with clear specs and deep private‑label benches have already outrolled the roll‑back, and the anxiety index floats downward as order sets in.

📚 Sources

- U.S. Bureau of Labor Statistics (BLS) — CPI, core goods/services trends: https://www.bls.gov/

- U.S. International Trade Commission / Office of the USTR — tariff actions and notes: https://www.ustr.gov/

- Congressional Budget Office (CBO) — analyses of trade policy and consumer impact: https://www.cbo.gov/

- International Monetary Fund (IMF) — research on pass‑through and inflation expectations: https://www.imf.org/

🌟 Final Insights

Stagflation‑lite is not fate; it’s a coordination issue. The 2025 tariff shock increases costs, although whether it congeals into a painful multi‑year headwind or is quickly defused depends on decisions made at checkout counters and loading docks and around cabinet tables. Homes that value maintenance and space‑efficient containers, not to mention unit‑price math, also stay on budget. Retailers who protect entry‑tier brand identity by focusing on container fill, milk‑run logistics, and audit speed maintain loyalty and margins. Policymakers who favor TRQs, standards fast‑tracks, and “theater” port dwell dashboards over grandstanding prevent temporary friction from rewriting price norms. Drift is combatted with discipline and transparency.

👉 Explore more insights at GlobalInfoVeda.com