🧭 Introduction

India Tariff Impact: A surprise burst of tariffs from the United States is exactly the kind of external jolt that strains the India economy. Headlines train on near-term hit rates for exports, currency wobble and sell-offs but the deeper story is about resilience architecture — the plumbing of payments systems, credit issuance, supply chains and household demand. Over the past decade, India has quietly rewired that plumbing: the UPI rails compress cash cycles, sick credit through the GST cleaned input credits, the Account Aggregator framework opened up cash-flow underwriting for MSMEs and an IFSC ecosystem began to price trade risk at home. In times of tariff wars, this foundation becomes more important than the news cycle. Enter this explainer, which applies a cold-eyed analysis to the moment: how much damage we’re likely to suffer, areas of cushion, what industries are able to do now, and how policy makers can keep the Rapture off the glide path of G.D.P. growth as global conditions roll and pitch.

Meta description: Can the India economy withstand a U.S. tariff shock? A practical playbook for exporters, lenders, and households to sustain growth in 2025.

🧩 What a tariff shock actually does inside India’s value chains

When duty barriers wall up overseas, the first‑order effects are straightforward — some orders pause, some prices move. The second‑order effects, though, are where companies win or lose. Working capital is stretched as foreign customers re‑negotiate terms, DSO rises and trade credit becomes more expensive. Dwell times wait times in ports increase as paperwork builds; procurement teams scramble for alternative suppliers and tweak requirements. Currency hedges are tested, sometimes at the worst possible time. Yet transmission is not uniform. Domestic demand sectors or regional corridors (EU, GCC, Japan, ASEAN) turn around faster. Companies that have traceability, AEO status and clean compliance pipelines are clearing quicker and being awarded shelf space. So the net impact on the India economy ultimately comes down to mix: how much of the exposure lies in tariff‑hit HS codes versus services and non‑U.S. lanes, and how rapidly exporters can refactor SKUs without breaking retail price pegs.

📦 Where the pain concentrates—and why it’s survivable

- 🧵 Apparel & footwear: High U.S. exposure in basics; pass‑through pressures on price points under $20. Dual‑spec designs (value/premium) defend pegs abroad while holding first‑pass yield.

- 💎 Gems & jewellery: Discretionary category; volatility spikes first, but inventory is mobile and can pivot to GCC and EU seasons with festival calendars.

- 🔩 Auto‑components: Tooling and certifications slow switching; however, deep vendor ecosystems serve EU/Japan OEMs, giving reroute options.

- 🐟 Seafood: Cold chain and inspections are bottlenecks; cluster‑level shared freight raises container fill and keeps landed costs competitive.

- 🧪 Specialty chemicals: Compliance‑heavy but sticky once qualified; customers avoid supplier churn. Margins can hold if inputs are hedged.

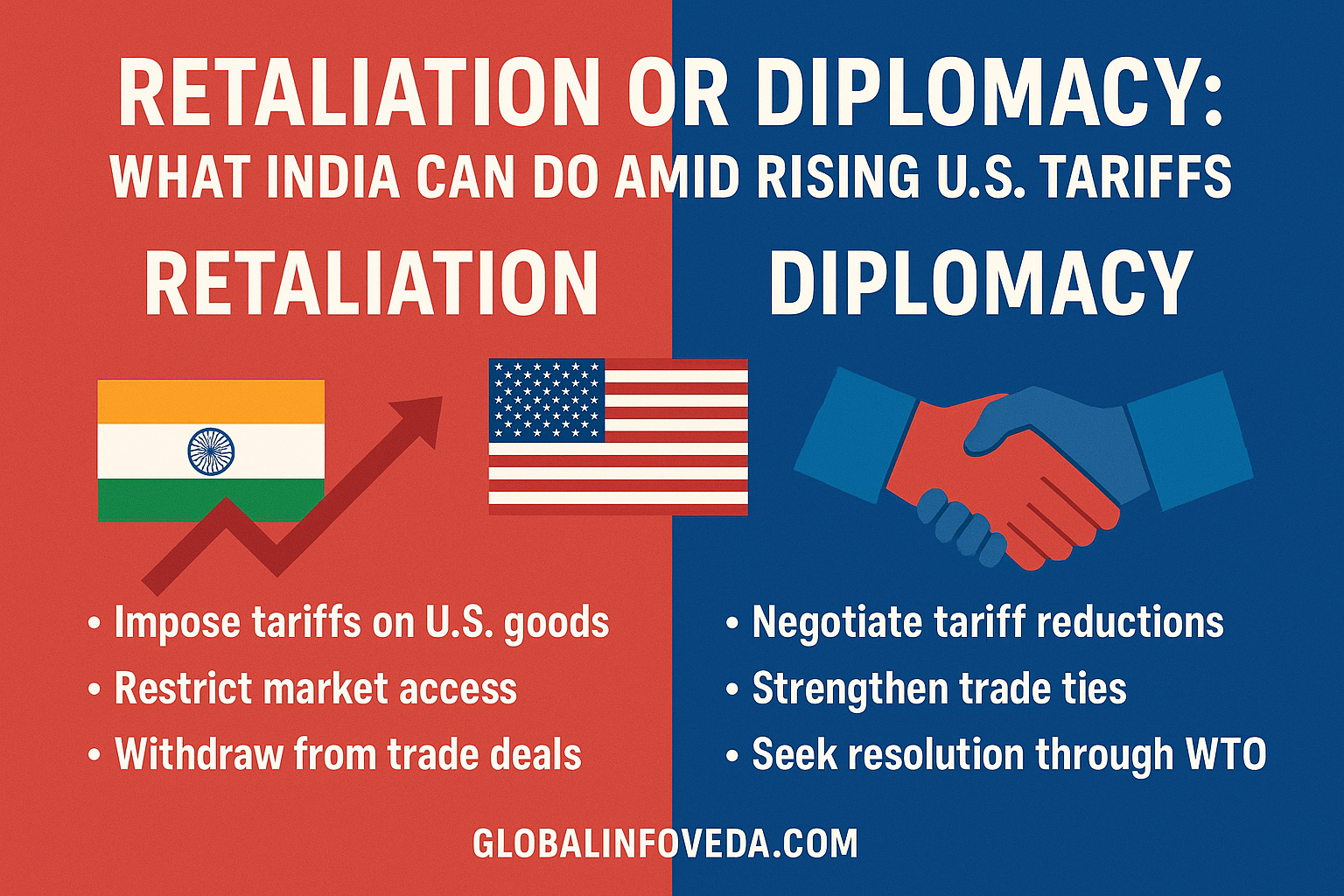

Read next for strategy breadth: Retaliation or Diplomacy: What India Can Do Amid Rising U.S. Tariffs

🧮 🔁 Three forces that blunt the blow in 2025

| 🧰 Buffer | 🧭 Why it helps | 📊 Practical signal |

|---|---|---|

| Domestic demand | Large home market absorbs inventory at a discount or in alternate SKUs | Stable retail footfall, resilient UPI ticket sizes |

| Open finance rails | Cash‑flow data enables faster invoice discounting; fewer failures | Falling DSO, steady credit turns |

| Regional diversification | Active lanes to EU/GCC/Japan/ASEAN reduce single‑market risk | Mix shift in export invoices, lower cancellations |

🏭 Why industry leaders still signal confidence

India’s turns in electronics, auto and engineered goods were already in motion before tariffs flared. It veered assembly and sub‑assemblies closer to home; stretched design capabilities; and broadened vendor bases. For many companies, the question is not will orders fall in the next quarter — it is will the order book last the year. In this case domestic consumption, services exports and increasing infrastructure outlays are buffering the hit. Companies also learned that the costs of the 2020–22 period are too high to bear, so they hold more supplier redundancy, strategic spares, and use milk‑run logistics to eliminate single points of failure. The result is a standard level of performance even in sea states. Markets can overreact in week one; factories need to live in week fifty‑one, where process beats panic.

🧠 How exporters can defend price and margin without racing to the bottom

- 🧰 Twin‑spec SKUs: Keep a value spec to defend pegs and a premium spec with durability/features; let retailers maintain laddering without eroding brand.

- 📦 Carton engineering: Reduce volumetric weight through smarter packaging; it’s the cheapest margin lever when freight is jumpy.

- 🧪 Quality before capex: Lift first‑pass yield with line discipline; avoid chasing output with new machines before fixing rework.

- 🧾 AEO & e‑CoO: Faster clearance beats price cuts. Documentation is a revenue tool when tariffs create queue discipline.

- 💱 Micro‑layered hedges: Hedge exposure in 10–15% layers over weeks; giant one‑shot forwards amplify timing risk.

🏦 What lenders and NBFCs can do to keep the flywheel moving

- 🔍 Score for governance: Reward exporters that publish hedge policies, OTIF, and DSO dashboards; penalize opacity.

- 🧮 Use Account Aggregator: Cash‑flow underwriting reduces collateral obsession and speeds invoice discounting during shocks.

- 🧰 Contingent credit lines: Pre‑approve small drawdowns tied to export milestones; cut disbursement friction.

- 🧾 Receivable insurance: Distribute risk via credit insurance so limits don’t vanish just when firms need them.

- 🧭 IFSC access: Route trade credit and risk pricing to India’s IFSC desks for speed and transparency.

Deep dive on finance plumbing: The Rise of Open Finance: From Banking to Full Financial Ecosystems

🧭 Households: keeping budgets calm when global prices are noisy

India’s household consumption is the silent engine that stabilizes growth. External shocks can raise prices of imported inputs — oils, electronics, metals — that feed into the price of everyday goods. The smart answer, at the family level, is boring but effective: be essentialist, buy repairable goods with local spare parts, and stay well clear of high‑APR EMI for fad upgrades. Tools like UPI make expense visibility real-time; leverage that to identify subscription creep and to time larger purchases around festival offers. For saving investments, mix SIP allocations with short duration debt and bit of gold ETF exposure–gold serves as volatility sponge and liquidity is still not compromised. The point is not to time markets; it’s to be prepared to have liquidity when you need it, so that you can weather shocks without getting derailed from your long‑term goals.

🔭 Scenarios that matter—and the moves in each

- 🟢 Easing: Partial carve‑outs emerge; lanes stabilize. Exporters reprice; banks loosen trade credit; rupee range narrows.

- 🟠 Sideways: Duties hold; orders fragment by month; hedging cadence becomes weekly; EU/Japan corridors deepen.

- 🔴 Escalation: Wider duties and tighter export controls. Firms rely on credit insurance, cash firewalls, and prioritized SKUs.

🧮 📈 Where the macro buffers sit today

| 🏦 Buffer | 🧭 Why it matters | 🔎 What to monitor |

|---|---|---|

| FX reserves | Two‑way liquidity stabilizes rupee moves | RBI’s market operations, forward book |

| Bank health | Lower NPAs keep credit lines open | Quarterly asset quality, capital adequacy |

| Capex cycle | Public capex crowds in private orders | Tender awards, execution milestones |

🧠 Case story — Tiruppur knits its way through volatility

U.S. orders were flat for an average knitwear cluster. Instead of dumping inventory, those three exporters coordinated shared freight, redesigned packs with less filler and created dual‑spec tee lines. An EU chain took premium line with heavier GSM and a value line had Christmas pegs. With AEO status, their containers were being cleared more quickly in the ports of their partners. DSO decreased 8 days; returns were reduced through better carton science; and the cluster employed women to inspect for quality gates, increasing first‑pass yield. Lesson: In times of shocks, coordination is the moat.

🧠 Case story — Seafood exporters make logistics a balance‑sheet tool

An Andhra Pradesh seafood firm realized the margin leak was not the product but container fill and dwell time. By joining a cluster‑led milk‑run pickup system and using smart liners to reduce melt, it cut wastage and improved landed quality. A local bank used the data to raise invoice‑discounting limits despite sector headwinds. Lesson: banks fund predictability; show it with data.

🧰 Policy levers that lower the bill without dulling deterrence

- 🎯 HS‑line precision: Negotiate targeted carve‑outs where the consumer incidence is highest; pair with strict origin proofs to prevent abuse.

- 🚪 Port predictability: Extend gate hours at major ports and publish dwell‑time dashboards so planners can cut buffer stock.

- 🧾 Sunset discipline: Time‑box retaliatory duties with clear review dates; certainty compresses risk premia embedded in prices.

- 🧰 Standards diplomacy: Push mutual recognition of certification and testing with trusted partners; compliant goods should clear fast.

- 🧪 Quality grants: Support MSMEs with testing and packaging upgrades rather than blunt subsidies.

🧠 Why the services engine steadies overall growth

India’s services exports — including IT, business process management, design and R&D — do not traverse customs with harmonized system (HS) codes unlike most other emerging markets. They rely on talent, digital infrastructure and client trust. When goods have headwinds, services frequently benefit from, at least, if not higher demand, solid demand as global companies find cost‑effective levers of productivity. The spillover to domestic demand is real: Wages in tech hubs also support consumption in housing, retail and other urban services. Policymakers should thus regard services as a stabilizing force and expedite moves that increase the supply of talent — such as apprenticeships, recognition of credit for modular learning, and visa diplomacy to maintain open project pipelines.

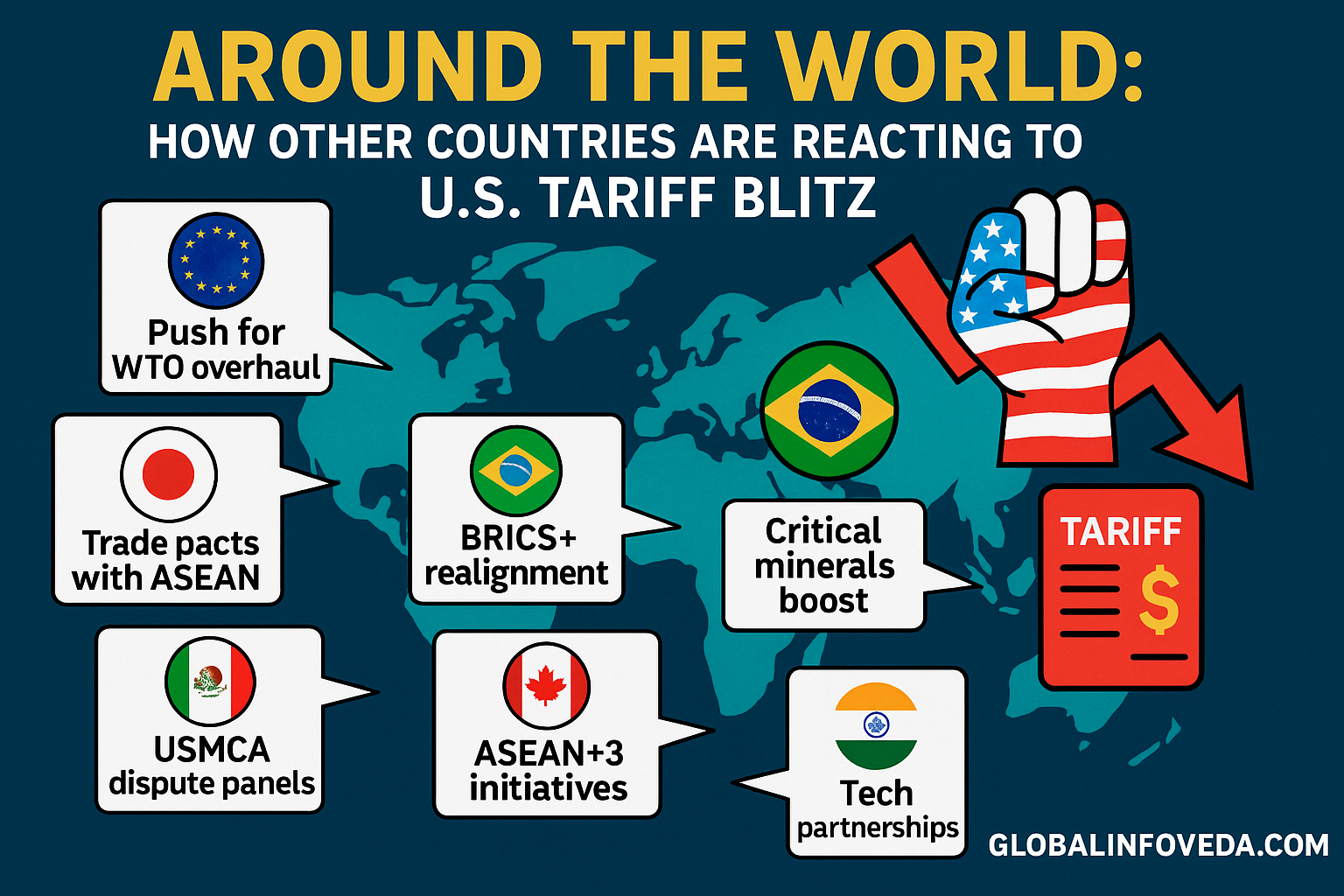

🧭 Regional playbook: EU, GCC, Japan, ASEAN

- 🇪🇺 EU: Quality and compliance win. Invest in REACH/RoHS knowledge, green claims discipline, and packaging recyclability.

- 🇶🇦 GCC: Festival calendars and gold demand cycles support jewellery and fashion; logistics reliability is prized.

- 🇯🇵 Japan: Precision and punctuality trump raw price; co‑develop specs with buyers; small defects ruin trust.

- 🌏 ASEAN: Complementary value chains in electronics and auto; near‑shore sub‑assemblies to maintain responsiveness.

🧠 Myth vs reality for the India economy in a tariff year

- 🧨 Myth: “Tariffs abroad will crash India’s exports across the board.”

✅ Reality: Impact is uneven by HS line; EU/GCC/Japan corridors cushion; services remain strong. - 🛑 Myth: “Hedging is for big companies only.”

✅ Reality: Micro‑layered forwards are accessible; lenders reward documented policies with better limits. - 🧰 Myth: “Cut price to keep orders.”

✅ Reality: Twin‑spec and packaging changes protect pegs without destroying brands. - 📉 Myth: “Banks will pull every limit.”

✅ Reality: Clean data—DSO, OTIF, first‑pass yield—keeps credit alive.

🧮 🧰 Side‑by‑side — where firms should spend the next rupee

| 💸 Spend area | 🧭 Payoff logic | 🔎 Evidence to track |

|---|---|---|

| Packaging & fill | Low capex, high freight savings | Rising container fill %, lower damage returns |

| Quality gates | Fewer reworks, faster cash cycles | First‑pass yield, warranty calls |

| Compliance training | Faster clearance, new lanes open | Fewer inspection holds, AEO upgrades |

🧠 How retailers can keep shelves honest without sticker shock

- 🏷️ Good‑Better‑Best ladders: Avoid fake value. Keep the good tier honest on spec; raise features in better/best so consumers see fairness.

- 🧾 Promotion discipline: Shorter but predictable promo windows reduce chaos and protect margins.

- 📦 “Pack math” transparency: Clear net quantities; avoid stealth shrink; shoppers reward trust.

- 🧰 Returns hygiene: Tariff years see more returns when specs drift; invest in diagnostics and exchange policies that save loyalty.

🧭 City‑by‑city notes for India

- 🏙️ Bengaluru: Services cash flows cushion retail; logistics pressure shows in last‑mile costs—optimize urban consolidation.

- 🌆 Mumbai: Import‑heavy sectors feel price spikes; diversify buyer bases; use IFSC tools for trade finance.

- 🏛️ Delhi‑NCR: Apparel clusters can lean on AEO and shared freight hubs.

- 🐯 Surat/Rajkot: Gems and engineering goods require quality labs; publish certifications publicly to win trust.

- 🌾 Ludhiana: Knits and cycles—focus on carton science and dual‑spec.

🧠 Communication that keeps lenders, buyers, and teams aligned

In uncertainty, credibility buys time. Exporters should send weekly two‑pager updates with order book, DSO changes, OTIF, returns, and hedge coverage. Buyers appreciate clean spec maps that show what changed and why retail pegs remain fair. Internally, teams need a single owner for hedging cadence and a calendar that links procurement, production, and shipping to FX windows and port dwell trends. The outcome is fewer surprises and limits that stay open.

❓ FAQs

Will the rupee weaken sharply on tariff headlines? Short spikes are common, but FX reserves and two‑way liquidity operations typically smooth moves; hedging in layers is smarter than guessing the bottom.

Do MSMEs have a chance when compliance costs rise? Yes. Cluster services—shared testing, documentation pods, and AEO drives—spread costs and level the playing field.

Is shifting to third‑country routing a silver bullet? It reduces duty exposure but invites rules‑of‑origin scrutiny. Pair routing with airtight documentation.

What’s the best near‑term investment? Packaging, quality gates, and data transparency beat flashy capex in a choppy year.

Can households ignore market noise? They should focus on liquidity, repairability, and measured SIPs; timing the index is less valuable than avoiding debt traps.

🧰 A 90‑day action calendar for exporters

- 📆 Days 1–10: Freeze spec maps; set twin‑specs; publish hedge policy; enroll in AEO if eligible.

- 🚚 Days 11–30: Carton/packaging redesign; join cluster freight; begin weekly lender updates.

- 🧪 Days 31–60: Pilot alternate lanes (EU/Japan); lock certifications; run first milk‑run.

- 📊 Days 61–90: Review DSO improvement; trim returns; negotiate IFSC‑based credit with insurance overlay.

🧠 Personal analysis—why India probably shrugs more than it slumps

There are three ingredients that shift the odds toward resilience. First, the demand floor: A giant home market, with increasing digital payments intensity, keeps small firms liquid and shelves moving. Second, the services flywheel: sticky client relationships and ongoing productivity plays offshore help sustain IT/GBS pipelines even when the product gets choppy. Third, the policy habit: those incremental yet relentless improvements – e-CoO, risk‑based inspections, account‑to‑account data pipes – all accumulate. None of this cancels out a year of tariff years; the best case scenario is slower growth, not contraction. For export-heavy districts, it will seem like a tough year; for the India economy as a whole, the architecture points to good times with work.

🧠 Extended sector drill‑down—where resilience and risk truly sit

India’s export mix is not a monolith, and the tariff shock tests each slice differently. Understanding these nuances helps companies and lenders avoid blunt, binary calls and instead make precise moves that keep growth intact.

🔌 Electronics & electricals

The domiciling of assembly in India from PLI has increased resilience, but also introduced fresh dependence on foreign semiconductors, passives, and specialty plastics. As external obligations hike costs or sluggish flows through, Alexander says the wisest Indian OEMs do three at a time: First, freeze BOM drift and lock substitute parts that are functionally equivalent; second, use design‑for‑test to shrink the ramp-up period with new vendors; and third, negotiate multi‑sourcing down to the sub‑assembly level so that said PCB or harness stays switchable without scrapping the finished goods. For consumers, protecting the ₹9,999/₹14,999 pegs of entry phones and wearables is of more significance than running after bleeding‑edge features‑ – brands that adhere to pegs manage to maintain demand and absorb shocks through fast cost engineering rather than hiking prices. For the India economy, the short‑term win is capability: each round of cost re‑engineering enhances local vendor capabilities, a compounding asset when it comes to future ascents of the value chain.

💊 Pharmaceuticals & healthcare supplies

Done‑dose exports are less bruised by direct tariff heat than APIs and input chemicals, but logistics friction still nibbles at sterile timelines. But leading companies buffer with ring‑fenced cold chain, pre‑cleared batch records and site‑ready mock audits that minimize inspection holds back into the U.S. Where supply scrutiny is tightening at the source, India’s advantage is documentation muscle — audit-ready traceability that satiates regulators without holding up the goods. Keep the cost‑sensitive generics running as fast as possible; anything that cuts dwell time saves both margins and the availability of medicine themselves. On domestic markets, A well‑telegraphed National List of Essential Medicines pricing posture stabilizes expectation at the level they do not cascade into retail shortages: shocks.

🚗 Machinery, auto & precision engineering

Precision suppliers succeed not by promising zero defects overnight, but by posting process capability metrics that allow buyers to price risk with certainty. When duties mess up routing, factories that keep OTIF above 95% get shelf space back first. They do so with small, mundane manoeuvres: cell by cell andon discipline, poke‑yoke fixtures to block repeated mistakes, milk-run logistics to even out dispatch. A lull on U.S. orders is manageable if EU/Japan lanes will tolerate a somewhat higher lead time combined with visibility on a dashboard; the reverse — opaque promises — burns trust more rapidly than tariffs.

🥭 Processed foods & agri value chains

Festival calendars tend to swing in food categories. When U.S. lanes have a hiccup, the GCC and East Africa take some of that volume — if exporters have phytosanitary and traceability documentation to do it. The lever is packaging: from oxygen barrier films and smart liners to carton design, they can boost container fill and decrease spoilage without messing with core taste profiles. At home, steady PDS and mandi operations anchor price expectations for inputs, preventing processors from panic‑buying.

🧪 Specialty chemicals & materials

This is a sticky business once qualified. The core risk isn’t a single tariff but customer requalification delays when suppliers swap solvents or adjust spec. Winning players maintain parallel validation tracks and pre‑negotiate tolerance bands with buyers. The upside for India is secular: as global buyers diversify, compliant Indian plants with strong EHS and zero‑liquid‑discharge credentials take share.

🌾 Rural demand dynamics most people ignore

Rural income represented by monsoon, MSP policy, MGNREGS and agri input price shape this demand floor of the Indian economy. One tariff year could boost prices of farm plastics, small motors and imported nutrients. However, if the monsoon is normal and MSP procurement is timely, village liquidity cushions some of that pain. The smart retail strategy in the hinterland isn’t lots of SKUs but honest packs, with distinct net quantities and availability of durable spare parts for pumps and mixers. Micro‑service centers operated by women’s self‑help groups prolong the life of assets, helping rupees to go further when imports are more expensive.

🛣️ Logistics and port modernization—micro‑moves with macro payoff

Predictable ports reduce risk premia that get capitalized into prices. Three changes speed recovery: longer gate hours in major ports for exporters to mellow dispatch times; risk‑based inspection that incentivises clean AEO and e‑CoO records; and live dwell‑time dashboards that enable planners to match hedging windows to sailing schedules. Inland, urban consolidation centers minimize last‑mile chaos and diesel burn, shaving more cents per that multiply across millions of appearances. Each hour shaved off dwell is a soft stimulus to the economy of India.

📈 Equity and bond markets—how finance should read a tariff year

The first week usually batters everything that has “export” in the descriptor before analysts model in the actual HS‑line exposure and mix shift. Cash‑rich midcaps with clear order books and that are conservative about hedges frequently have a quicker recovery than the mass‑held exporters with low disclosure. On bonds, exporters with receivable insurance and disciplined FX policies held spreads while opaque borrowers have limits reeled in. For households, SIPs are the proper stance — averaging through noise — while maintaining short‑duration debt as a ballast. The trick is not predicting the bottom just to refuse to sell resilience to pay for panic.

🧮 Employment elasticity and the real jobs story

Newspaper headlines around jobing are noisy in tariff years. The export shop that makes a line stop would get attention; the service firm that adds a client in effect does not. The economics of employment are elastic: you need more heads per garment and footwear than per precision chemical or IT service. That’s why cluster policy matters. When a district is building shared labs, freight desks and quality gates for training, it is reducing the pain of dips and the need for layoffs. During the course of a year, the city’s rubbery levels of service wages frequently balance out the factory-based noise in city demand—another reason why the India economy shrugs rather than slumps.

🌍 Diaspora flows and remittance cushions

Remittances from the Gulf, North America, and Europe function as shock absorbers. When goods cycles wobble, family transfers often rise for a quarter, smoothing consumption. Fintech channels that cut remittance friction—lower fees, better FX—are effectively counter‑cyclical policy tools. Encouraging diaspora to route savings into NRE/NRO deposits and local bonds deepens the domestic liquidity pool during choppy months.

🏘️ Urban affordability, rentals, and SME resilience

When imported fixtures and appliances become more expensive, the ripple effects are felt in rental markets, where landlords put off upgrades or pass along the costs. City administrations can soften this trend with speedier approvals for retrofit projects, bulk procurement of common fixtures and fiscal nudges towards repair over replace. For SMEs, that have means for demand aggregation of packaging, labels, they can move on basic MRO parts that lubricate their shop floors, and enjoy scale pricing, without falling back on predator credit.

🧪 Measurement framework—12 KPIs that tell you if the economy is shrugging

- 📦 Port dwell time (days) — falling signals smoother clearance.

- 📈 UPI average ticket & frequency — steady or rising means consumption resilience.

- 💳 Invoice discounting limits used (%) — healthy usage shows lenders’ confidence.

- 🧾 DSO (days) — shrinking means buyers are paying; liquidity improving.

- 🔧 First‑pass yield (%) — rising shows process discipline beating volatility.

- 🚚 Container fill (%) — improvement indicates freight efficiency gains.

- 🧪 Inspection holds (per 100 shipments) — fewer holds reflect compliance strength.

- 🧮 Hedge coverage (%) — layered coverage suggests mature risk management.

- 🧰 Warranty calls (per 1,000 units) — steady calls imply honest spec maintenance.

- 🏬 Retail footfall index — stable footfall signals consumer confidence.

- 💵 Trade credit spreads (bps) — tighter spreads show trust in exporter books.

- 🔄 OTIF (%) — on‑time, in‑full delivery rising equals logistics reliability.

🧭 State‑level compacts that change outcomes

States can run AEO enrollment drives, co‑fund traceability labs, and set up freight exchanges to match loads and reduce empty returns. District skill missions should prioritize quality gate training and carton science over generic curricula. Small, precise steps—transparent procurement calendars, public dwell dashboards, and a single‑window for e‑CoO—convert national policy into everyday competitiveness.

🧰 Exporter toolkits—practical assets teams should deploy

- 🧩 Spec maps that flag any material or process change against a baseline, shared with buyers to prevent surprise returns.

- 🧭 Hedge cadence calendar linking purchase orders, dispatch, sailing dates, and FX windows.

- 🧾 Two‑page lender updates covering order book, DSO, OTIF, returns, and hedge coverage.

- 🧪 QC checklists with photographic standards so line operators align on pass/fail quickly.

- 🚚 Milk‑run routings and container fill sheets that visibly track ROI from logistics tweaks.

❓ Extended FAQs

Are targeted carve‑outs worth the negotiating effort? Yes. Precision on HS lines with high consumer incidence lowers political resistance abroad and reduces backfire at home. Pair with strict origin proofs to prevent leakage.

Should exporters slow capex plans? Replace “pause or go” with “sequence smartly.” Fund quality, packaging, and compliance now; stage large machinery once lanes stabilize.

Do alternative payment rails help? Domestic rails like UPI speed cash cycles; internationally, reliable correspondent channels and IFSC desks reduce frictions that would otherwise get priced into offers.

What about climate and ESG in a tariff year? Far from a luxury, credible EHS and recyclability claims open EU/Japan doors when U.S. lanes are noisy. Compliance is revenue.

Will households cut big‑ticket purchases? Some will delay, but clear festival promotions and honest specs keep conversion. Brands that respect pegs and avoid stealth shrink retain trust.

🧠 Leadership cadence for a resilient 2025

Executive teams that win in noisy years run a cadence: weekly operations room with KPIs, biweekly buyer calls that align specs and calendars, monthly lender reviews that keep limits open, and quarterly board check‑ins that force honest risk assessment. The drumbeat matters more than any single heroic move. Over the year, this cadence compounds into credibility, and credibility into credit.

📚 Sources

- Reserve Bank of India (RBI) — Monetary Policy, External Sector, and Payments updates: https://www.rbi.org.in/

- Directorate General of Foreign Trade (DGFT) — trade facilitation, e‑CoO, and policy circulars: https://www.dgft.gov.in/

- Ministry of Finance, Government of India — budget, customs notifications, and policy statements: https://finmin.nic.in/

- Ministry of Commerce & Industry — export promotion councils, AEO information: https://commerce.gov.in/

🌟 Final Insights

A U.S. tariff shock is a stress test, not a judgment. The India economy begins the fiscal year 2025 with enhanced digital rails, creditor-friendly transparency and a services engine that serves as a cycle-soother. The winners will be businesses that treat packaging and quality as finance treatment that publish data to maintain the open limits, and that build twin‑spec products to defend the pegs across markets. Policymakers need to stay on the boring, compounding work — precision on HS lines, faster ports, time‑boxed response, and standards diplomacy — so that the consumer, not consumer prices, pay for geopolitics. Households can defend against this with cash flow discipline and reversible decisions. Shrugging off the shock doesn’t mean breezing past it; it means turning a year of friction into a year of process upgrades India gets to keep after the fan noise fades.

👉 Explore more insights at GlobalInfoVeda.com