🧭 Introduction

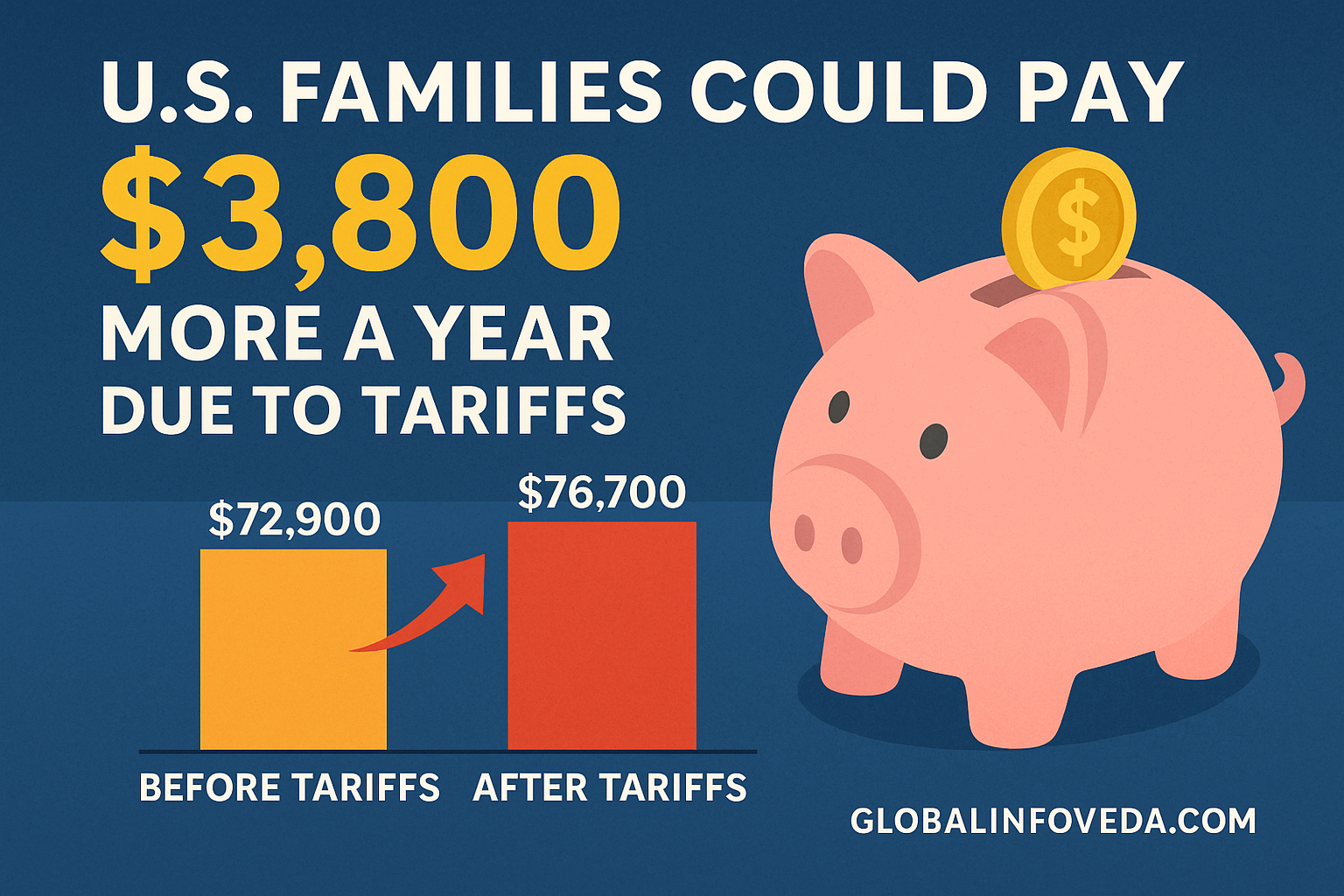

Tariff Impact For many American families, a sudden ramp-up in tariffs doesn’t translate as policy; it shows up as a more expensive grocery bill, a costlier school-laptop purchase and even more stress in a car-repair budget. The headline estimate — $3,800 in extra annual spending for an average family — is abstract until you plug it into a basket, food, fuel, home goods, electronics, clothing and services that have imported inputs. This guide breaks down how trade duties become consumer prices, why the incidence isn’t evenly felt among income brackets or in the states, and what’s at stake for households, retailers and local governments to keep rising costs from sticking in the inflation index. We also look at the global knock‑on effects that loop back into the U.S. economy, because when supply chains wend new paths, the costs and the reliability both change. Throughout, the focus is practical: Protect the household budget first, then consider portfolio and policy.

Meta description: How tariffs add up to $3,800 a year for U.S. families—with playbooks for budgets, retailers, and policymakers to curb consumer price pain.

🧮 How a $3,800 burden forms inside a household budget

The often‑cited figure of $3,800 is best taken as a pile‑on of pass‑throughs from assessed import duties to shelf tags. In the first, wholesalers and retailers pass on a high share of cost because margins are thin and volumes big; in the second, sellers play with list prices, pack‑sizes and promotions to keep loyal customers. Freight and port dwell time margins exacerbate shocks, as do rules‑of‑origin changes that necessitate repapering. Crucially, the death by a thousand cuts comes in waves: first in tradables (appliances, apparel), then in inputs into services (equipment for salons or clinics) and then through expectations, where sticker shock nudges households into delaying replacement cycles — ironically increasing costs for repairs. This is why families feel “everywhere is more expensive,” even if only some line items bear direct duty. The good news is that households can respond with timing, substitution and maintenance; the better news is that retailers can redesign packs and sourcing to take the edge off when policy remains predictable.

🛒 Budget impact you will actually notice

- 🧾 Groceries: Imported oils, canned goods, and specialty ingredients creep up. Private‑label swaps and recipe rotation offset part of the rise.

- 📱 Electronics: Laptops, phones, and peripherals see jumps when semiconductors and boards face duties; certified refurbs and extended warranties protect cash.

- 👖 Apparel/Footwear: Entry‑tier price pegs break first (under $20 items). Dual‑spec designs let brands hold pegs while trimming non‑core features.

- 🧰 Home repair: Imported fixtures, small motors, and tools become pricier; repair culture and local spares keep projects affordable.

- 🚗 Mobility: Parts and tires rise more than fuel in some cycles; maintenance cadence avoids compounding wear that leads to big‑ticket failures.

- 🧒 School/childcare: Devices and supplies cost more when imported inputs rise; staggered purchase calendars and buy‑back programs help.

🧠 The three channels that turn tariffs into price tags

| 🧰 Channel | 🧭 What changes | 📊 What you see at the store |

|---|---|---|

| Direct duty | Import cost increases on finished goods | Higher list price or smaller pack‑size |

| Input pass‑through | Duties on parts/ingredients lift production cost | Subtle spec changes; fewer promos |

| Friction costs | Delays, compliance, and re‑routing add overhead | Stock‑outs, limited models, longer wait times |

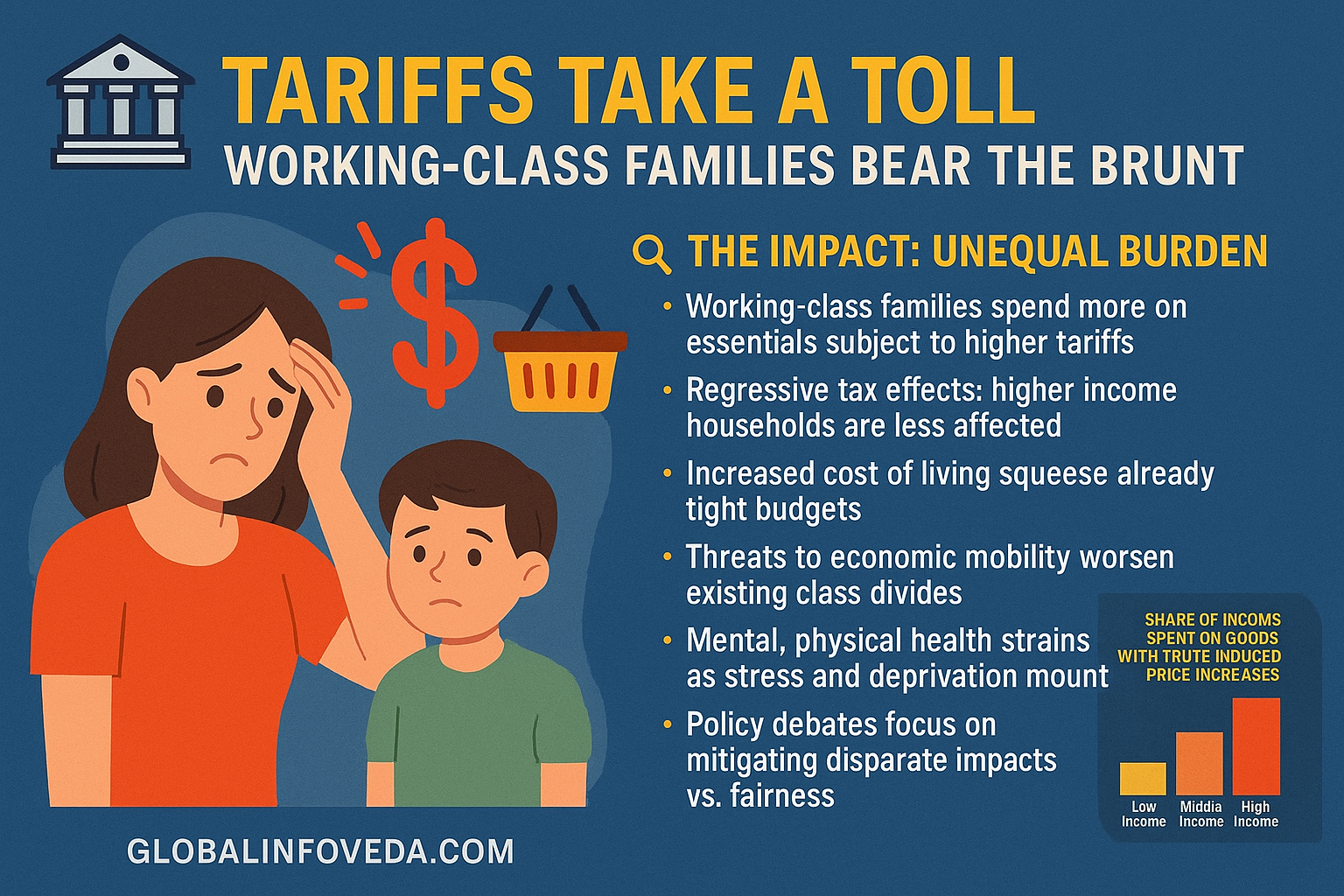

🔍 Why the incidence is uneven across income tiers

And the incidence of tariffs is not a flat tax in the real world. The entry‑tier shopper has a greater proportion of spending in tradables that are most affected by tariffs and a lesser buffer to pre‑purchase during sales. Middle‑income families can space out major purchases and rely on private‑label options. Premium durable goods and imported autos hurt higher‑income households the most, but their share of budget is more limited. Geography matters, too: The pass‑through may be faster in a coastal state that relies heavily on imports of fresh vegetables or has high housing‑related repair cycles than an interior state where substitution is easier. Families with teenagers, finally, live the life of the device replacement cycles that underscore any electronics duty. Recognizing these asymmetries is useful for targeting short-term relief — smart TRQs; maintenance subsidies for key appliances; and Trinidadian-style transparent pack math for staples — all of which make it less likely that you’ll end up with the kind of blip becoming a behavioral habit in response to sticker shock.

🧰 Ten practical steps for households to defend the wallet

- 🗓️ Calendar big purchases around anchored sale windows; brands plan genuine discounts there.

- 🧮 Unit‑price literacy: compare price per ounce/gram; avoid paying more for cosmetic “new” SKUs.

- 🔧 Maintenance first: oil changes, filter swaps, and tire rotations prevent expensive failures when parts cost more.

- 🧴 Refill culture: pick products with bulk refills; per‑use cost falls even if list prices rise.

- 🧼 Private label: retailer brands adopt new sourcing faster; quality often matches national brands.

- 🔁 Buy‑back & refurb: certified refurbs in electronics stretch the cycle without reliability risk.

- 🧰 Repair networks: support local repair shops with transparent quotes; avoid one‑brand lock‑in.

- 🧾 Subscription audit: trim auto‑renew clutter and redirect savings to maintenance.

- 🛒 Basket sequencing: split discretionary from essentials; don’t let “nice‑to‑have” items crowd out staples.

- 💡 Energy efficiency: small upgrades (LEDs, weather‑stripping) blunt utility bills when everything else inflates.

🧩 The recession question—and why tariffs can feel like one without being one

Tariff periods are often described by households as a “shadow slowdown.” That’s because the stickiness of prices compels trade‑offs: a postponed fridge, a delayed set of car tires, a few fewer dining‑out nights. Not one of these is a recession signal by itself, but the experience of living through it is going to be tighter since inflation expectations tend to anchor around observable categories. Retail metrics are illustrating this in suspiciously indicative movements — robust footfall, depressed average basket sizes and a tilt to entry‑tier pegs. The Big Picture: Tariffs reallocate demand inside the consumer wallet, penalizing low-margin staples where pass-through is the highest. Accordingly, policymakers should take extra care to head off second‑round effects, such as wage‑price spirals, by accompanying duties with time‑boxed scopes or targeted relief for high‑incidence staples. That is what prevents a stingy year from turning into a pessimistic decade.

🧪 Case study—A four‑person family in Ohio re‑maps the year

Now think about a Columbus, Ohio, family of two adults and two children. Their 2025 plan involved a mid‑range laptop for school, replacing a broken dishwasher and driving around the country in the summer. If it turns out that prices of electronics and appliances rise 8 to 12 percent after tariffs are lifted, these sequences will occur differently. One, they are maintenance related: a $90 dishwasher seal kit and a $150 service call, say, that put off a $700 replacement by 12 months. They can buy a two‑year‑warranty‑certified‑refurb laptop and save $220 over a new one. Third, they move the road trip to shoulder season to take advantage of hotel and fuel discounts. Net effect: despite higher consumer prices, they succeed in capping spending growth at ~$1,400 instead of $3,800 as they exercise levers they fully control — timing, maintenance, and substitution.

🧪 Case study—A single parent in Texas keeps school costs stable

A single parent in San Antonio is looking for a dependable phone upgrade and school supplies for two children. Carrier deals on older models as well as a powerful trade‑in cut the handset cost by 35%. For supplies, a move to private‑label notebooks and refillable markers anchors the basket. A store credit card is alluring, but they are able to sidestep high‑APR financing by making purchases across two pay periods. The family is also part of a buy‑nothing community group for certain items. Result: even with higher tariffs, the school‑year budget comes in within last year’s range.

🧠 How retailers can carry part of the burden without wrecking margins

Retailers are the most potent inflation keepers that households never notice. The most innovative operators redesign packs, rationalize assortments and work the math on freight to claw back cents that support pegs. They are investing in carton engineering to raise container fill, tightening OTIF with vendor scorecards and discourage stealth shrink to preserve trust. They keep the good-better-best ladder honest: a somewhat fair entry tier rewards loyalty, and the premium tier is burdened by by design features constraints. When tariffs shoot up, retailers also step up maintenance parts promotions — filters, belts, batteries — because avoiding breakdowns saves customers way more than a coupon on that depreciating gadget.

🧭 Merchandising checklist for a tariff year

- 🧾 Entry tier integrity: keep spec honest; no stealth shrink.

- 📦 Assortment trims: fewer, deeper SKUs improve negotiating power.

- 🧪 Audit cadence: rapid re‑certification so replacement suppliers clear compliance in weeks, not months.

- 🚚 Milk‑run logistics: cluster pickups cut damage and dwell; publish route scorecards.

- 🪛 Service bundles: filters, wipers, and belts tied to SMS reminders avert big repairs.

- 🏷️ Promo discipline: predictable windows, shorter duration—customers plan around certainty.

- 🤝 Private‑label trust: share spec cards publicly; prove value, don’t just claim it.

🧮 What policy levers actually lower the household bill

Policy makers frequently reach for the noisiest tool — blanket duties — and then they’re surprised consumer prices remain high. What instruments look like: the instruments that succeed are quieter: targeted tariff‑rate quotas (TRQs) that cap consumer incidence on staples; standards diplomacy so compliant goods clear faster; port dwell transparency; time‑boxed retaliatory actions with sunset clauses that shrink risk premia. Combining tariffs with receivable insurance assistance for small importers helps keep the shelves stocked, because credit lines do not evaporate.” Community ‘Fixerspace’ moves matter, as well: from subsidized repair cafes and do‑it-yourself playstations to tool libraries and energy‑efficiency kits, community investments produce durable savings that outlast the news cycle.

Policy precision vs spectacle: Retaliation or Diplomacy: What India Can Do Amid Rising U.S. Tariffs

🧮 📊 Side‑by‑side—policy instruments and what families feel

| 🧰 Instrument | 🧭 Intended effect | 🧒 Household experience |

|---|---|---|

| TRQs on staples | Cap shelf shock on essentials | Stable basket for oils, grains, dairy |

| Standards fast‑track | Speed clearance for compliant goods | Fewer stock‑outs; predictable models |

| Port dwell dashboards | Cut hidden friction costs | Shorter waits; more reliable delivery windows |

🧠 The services angle—why prices for haircuts and checkups rise later

People want to know why services inflation is lagging goods inflation in tariff years. The answer is inputs: salons and clinics import equipment, consumables and spare parts. As those costs go up, providers either pass that along in higher fees or shifting tiered, as in basic vs deluxe, while not moving posted rates. A second reason is labor mix: as retail slows down, some workers move to service temp gigs, temporarily holding back wage growth; pockets of scarcity arise months later and wages adjust. Households can offset this by signing up to membership plans which level-off pricing, get our referb equipment into community clinics, and schedule maintenance annually during provider off‑peaks.

🧭 State‑by‑state differences that shape the bill

- 🌉 California: Strong import reliance and higher compliance costs; shoppers lean hard on private‑label and subscription trims.

- 🏙️ New York: Dense transit lowers fuel sensitivity but imported food and apparel raise exposure; refurb electronics are common.

- 🌵 Texas: Car‑heavy patterns mean parts and tire costs loom; DIY repair and tool libraries deliver outsized gains.

- 🏔️ Colorado: Outdoor gear costs rise with imported textiles; off‑season buys and consignment swaps help.

- 🌽 Iowa: Food baskets feel it less; appliances and farm‑adjacent small motors pinch more.

🧠 Myths that raise your bill—and what’s accurate instead

- 🧨 Myth: “Everything is more expensive, so timing doesn’t matter.”

✅ Reality: Anchored promo windows deliver real savings; timing beats guessing policy. - 🧰 Myth: “Repairs are throwing money away.”

✅ Reality: In tariff years, maintenance yields the best ROI—delays replacements until pegs normalize. - 🧴 Myth: “Private‑label means low quality.”

✅ Reality: Many retailer brands co‑manufacture with national brands; specs can be identical. - 📦 Myth: “Shrinkflation is inevitable.”

✅ Reality: Honest pack math retains loyalty and can be demanded with your wallet.

🧪 Case study—A Midwestern grocer protects pegs without stealth shrink

A regional chain refused to cut pack sizes. Instead it renegotiated carton specs, consolidated SKUs, and published spec cards for private‑label staples. It also launched a “refill aisle” for cleaning supplies and personal care. Result: entry‑tier pegs held; brand trust rose; basket sizes stabilized. Staff tracked damage returns and container fill weekly, creating a culture where friction costs—not customer value—were the enemy.

🧭 How to read corporate statements in a tariff year

When brands announce “price investments,” they usually mean holding entry‑tier pegs while raising feature tiers to fund costs. Look for three tells: fewer SKUs (a sign of assortment discipline), transparent spec sheets (confidence), and cleaner warranty terms (trust). If you see stealth shrink and murky specs, treat promos skeptically. Households are powerful negotiators at scale; retailers respond to what sells, not what they declare.

🧮 What investors should actually watch

- 📈 Gross margin stability alongside flat or rising container fill—proof that packaging and logistics, not sticker hikes, did the work.

- 🧾 Receivable insurance coverage—keeps credit flowing to small importers that stock shelves.

- 🧪 Inspection hold rates—declines indicate compliance muscle that lowers cost volatility.

- 🧰 Warranty claims—falling claims in a tariff year suggest honest specs and better build.

- 🧮 Hedge cadence—layered FX coverage beats one‑shot gambles.

🧠 Education and school tech—keeping learning affordable

Both public school districts and families experience electronics duty pass‑through. Districts can also aggregate procurement to trap fair specs for Chromebooks and tablets, mandate repairability clauses and stock spare parts. Families should also prefer devices that have longer update windows and standard ports, like the ones that last a little while and take in cheaper accessories. A shared buy-back lane cuts down on e-waste and saves money. When tariffs raise prices by 10 percent, a longer life span more than makes up the delta over two school years.

🧭 90‑day household action plan

- 🧰 Week 1–2: Maintenance sprint—filters, oil, tires, seals; fix small faults before they cascade.

- 🧾 Week 3–4: Subscription cleanse; cancel low‑utility auto‑renews and redirect savings to emergency fund.

- 🛒 Week 5–8: Basket re‑map—private‑label trials, unit‑price checks, refill swaps.

- 📱 Week 9–10: Device strategy—consider certified refurb, verify warranty and update support.

- 🧴 Week 11–12: Restock staples during anchored promos; avoid panic bulk that strains cash flow.

🧠 Local government’s quiet superpowers

City halls can do more than issue statements. They can seed repair events, publish price‑integrity dashboards for essentials, and coordinate bulk buys for small clinics and shelters. Public libraries can expand tool lending and device checkout, offsetting school tech costs. Port cities can convene shippers and importers to smooth dwell time, an invisible tax that residents pay at the till. The most effective leaders focus on small frictions that compound into big savings.

🧠 Personal analysis—why $3,800 isn’t destiny

The $3,800 headline is a wake‑up call, not a bill you have to swallow. Still, there is variance around that average. A family who runs a maintenance sprint, switches to a private‑label product when quality is demonstrated, and times big buys against a transparent promo calendar can halve that effective hit or more. Retailers who make little compromises as the highest and make investments in carton engineering and audit speed will hold loyalty and share. Policymakers that pair tariffs with TRQs, standards fast‑tracks, and visible port metrics will ensure that the shock won’t stick. In other words: A year of friction can turn into a year of process improvements if we point policy and practice at the right bottlenecks.

🧮 📈 Side‑by‑side—household types, exposure, and best first move

| 👪 Household type | 🎯 Exposure hot‑spot | 🧰 Best first move |

|---|---|---|

| Two‑kids suburban | Electronics and auto parts | Maintenance sprint; certified refurb devices |

| Single urban | Groceries and services | Private‑label pivot; loyalty programs |

| Senior couple | Health equipment and utilities | Energy‑efficiency kits; service contracts |

❓ FAQs

Does buying “American‑made” avoid all tariff impact? Not entirely. Many “assembled in USA” goods contain imported components. Focus on repairability, warranty, and honest spec rather than label alone.

Is gold a hedge for households? Gold ETFs can stabilize portfolios, but emergency cash and maintenance deliver faster savings you can use.

Will prices revert quickly if tariffs are rolled back? Some will, but friction costs and renegotiated contracts can keep prices sticky. That’s why transparency on TRQs and port metrics matters.

Are warehouse clubs a reliable shield? Often, because scale improves container fill and negotiation power. Still compare unit prices and avoid bulk that expires.

📚 Sources

- U.S. Bureau of Labor Statistics (BLS) — Consumer Price Index and component weights: https://www.bls.gov/

- U.S. International Trade Commission / USTR — tariff actions and explanatory notes: https://www.ustr.gov/

- Congressional Budget Office (CBO) — research on trade policy and consumer impact: https://www.cbo.gov/

- International Monetary Fund (IMF) — pass‑through and inflation analysis: https://www.imf.org/

🌟 Final Insights

The $3,800 headliner should be a motivator, not a scare tactic. The mix of maintenance, private‑label substitution, and disciplined timing on big purchases can cut the effective hit in half for U.S. households. For retail, true entry levels, carton design and supplier fast audits keep loyalty high without the use of stealth shrink. For policy makers, TRQs, standards fast‑tracks, and port dwell dashboards that are in the open cut away some of the hidden taxes that consumers pay at the register. Combine those with the community level culture of repair and tool access, and a tariff year is an efficiency year. Here’s the game plan: shield the household wallet today and make the system more resilient for tomorrow.

👉 Explore more insights at GlobalInfoVeda.com