⚖️ Introduction

The 2025 wave of “Liberation Day tariffs” jolted trade lanes, boardrooms and kitchen‑table budgets in equal measure. But undergirding the news and sticker shock is a much quieter struggle: whether these executive‑driven tariffs can withstand a serious constitutional challenge in U.S. courts. On paper, Congress holds the taxing and commerce powers; in practice, statutes like Section 232 of the Trade Expansion Act and Section 301 of the Trade Act allow the President to move quickly when “national security” or “unfair trade practices” are cited. And the difficult question is not whether tariffs are legal in the abstract — it is whether these Liberation Day tariffs remained within the delegation, showed deference to procedural due process and respected the separation of powers. This explainer charts the legal terrain, the doctrines to watch, the most likely litigation paths, the government’s strongest defenses, as well as the real‑economy stakes for partners like India if courts prune (or fell) the policy.

Meta description: Can Liberation Day tariffs survive court scrutiny? Explore nondelegation, major questions, Section 232/301, standing, timelines, and likely outcomes.

📜 What exactly are ‘Liberation Day’ tariffs in legal terms?

Journalists may have coined the politically charged label, but courts will rape the branding from the name and inquire: Which statutory hooks did the administration hang this action on, and did it follow the statute’s procedural predicates? If the package relies on Section 232, the only question is whether the Secretary of Commerce conducted a proper investigation, made the requisite finding of a threat to national security from imports, consulted Defense, and the president’s remedy is consistent with that finding. If the package is based on Section 301, the U.S. Trade Representative must have found unjustified or discriminatory behavior that burdens U.S. commerce and balanced the response to induce compliance. A third, broader way is IEEPA (International Emergency Economic Powers Act), but even that must involve a declared national emergency connected to a unique and exceptional foreign danger. Labels aside, challengers win or lose on statutory fit, on the record and on the logic that connects cause with remedy.

🧭 Fast‑check essentials a court will care about

- 🧩 Statutory basis clarity: Is the tariff proclamation clearly tied to Section 232, Section 301, or IEEPA, with applicable cross‑references and deadlines met?

- 🧪 Administrative record quality: Do Commerce/USTR memos show evidence‑based findings, interagency consultation, and reasoned selection of HS lines and rates?

- 🧭 Causation & tailoring: Does the remedy reasonably relate to the threat or unfair practice identified, or does it look like an open‑ended industrial policy?

- ⏳ Timing rules: Were statutory report and action windows honored, and were extensions justified under the statute instead of improvisation?

- 🧱 Domestic process: Did agencies provide notice, engage with stakeholder comments, and address feasible alternatives?

- 🧰 Sunset & review: Are there periodic reviews, carve‑outs, or TRQs that suggest proportionality rather than permanent protectionism?

Related strategic framing: Retaliation or Diplomacy: What India Can Do Amid Rising U.S. Tariffs

🏛️ The constitutional architecture: who gets to tax and regulate trade?

The Constitution grants Congress the authority to lay and collect Duties, and to regulate Commerce with foreign Nations. Throughout the course of a century, Congress has enacted conditional delegations that enabled the Executive to address ever-evolving trade threats, provided that the statute furnishes an intelligible principle to guide the exercise of discretion. Trade delegations, such as the one for motorcycles, have been granted deference by courts. Older cases such as United States v. George S. Bush & Co. (1932) and Federal Energy Administration v. Algonquin SNG, Inc. (1976) upheld tariff modifications under delegated power on grounds of a workable standard and need in national security. But the current doctrinal climate is different. In the era of the major questions doctrine (see, e.g., the recent West Virginia v. EPA (2022)) and resurgent chatter about the nondelegation doctrine (see the Gundy v. United States (2019) concurrences), challengers will insist that Liberation Day tariffs implicate claims of tremendous economic and political consequence and hence should be predicated not on elastic readings of old language, but the affirmative statement of Congress. The government, by contrast, will rely upon Youngstown’s framework (foreign affairs and national security deference if Congress has authorized action) and the lasting strength of Algonquin for Section 232.

🧮 ⚖️ Comparison — the three main legal paths for emergency trade measures

| 🧰 Statute | 🧭 Trigger & process | 🧪 Judicial posture |

|---|---|---|

| Section 232 (Trade Expansion Act, 1962) | Commerce investigates national security harm; Defense consulted; President adjusts imports | Historically upheld (Algonquin); deference high if record ties remedy to security |

| Section 301 (Trade Act, 1974) | USTR finds unfair practices; seeks negotiation; may impose duties | Courts review for statutory fit and process; politics less shielded by “security” |

| IEEPA (1977) | National emergency declared due to unusual, extraordinary foreign threat | Strong deference, but requires real emergency nexus and tailored measures |

🧠 Doctrines that will shape the outcome

- ⚖️ Nondelegation doctrine: If courts view the statute as offering no meaningful intelligible principle, they could demand tighter limits—long shot, but context matters.

- 🧭 Major questions doctrine: For actions of vast economic significance, courts seek a clear congressional statement. Broad “security” or “unfair trade” clauses may face scrutiny if used as global industrial policy.

- 🛡️ Foreign affairs deference: Cases like Curtiss‑Wright and Regan v. Wald show courts’ inclination to defer where foreign policy is central—especially under IEEPA.

- 🧾 Administrative law baselines: Even when the APA formally exempts some tariff actions, courts still expect reasoned decision‑making and a coherent administrative record.

- 🧱 Equal protection & due process hooks: Tariffs rarely trigger suspect‑class analysis, but arbitrary country targeting without evidence can raise rational basis concerns.

🧑⚖️ Where the fight lands: CIT, CAFC, and potentially SCOTUS

The vast majority of trade disputes arise at the U.S. Court of International Trade (CIT), an Article III court with the authority to hear national cases pertaining to the customs law and international trade. Those appeals are to the Federal Circuit, and to the Supreme Court on writ of certiorari. Plaintiffs usually consist of importers, trade associations and sometimes states or consumer groups, assuming they can establish injury‑in‑fact. Relief includes preliminary injunctions (rare in tariff cases), vacatur or remand to agencies for clearer reasoning and sometimes refunds (if entries are liquidated under illegal tariffs). Fast by appellate standards but slow by business cycle standards: initial merits can take 6-12 months, and appeals another 6-12.

🧪 How recent case law sets the table

The legal baseline is not nothing. Am.Institute for Int’l Steel v. United States (Am. Institute II) (Ct. Int’l Trade 2019) The CIT—reluctantly but squarely—turned back a nondelegation challenge to Section 232 based on Algonquin and George S. Bush & Co. The Supreme Court denied review. Transpacific Steel LLC v. United States (Fed. Cir. 2021), the appellate court sustained the president’s power to adjust Section 232 actions within the statutory period, indicating that it’s willing to accept successive remedies that are linked to the initial determination. On the margins, courts have admonished agencies for process deficiencies, sternly reminding us that even in security‑labelled proceedings, agencies must follow findings with remedies and deadlines with compliance. Add the Supreme Court’s answe4rs-and-yes-no-at-the-same-time major-questions-and-perhaps-the-court-can-trash-regulatory-entire-scheme-to-smiggens-without-looking-at-the-broken-teeth-need reform-the-meme skit and you have a practical test: are Liberation Day tariffs an analyzable response to a proven harm, or open‑ended, elastic‑languaged, refashion‑society-as-we-see-it power to do whatever anyone might want?

🧰 What challengers will argue

- 🧭 Ultra vires use of statutes meant for discrete harms, not broad industrial policy; mismatch between harm found and remedy scope.

- ⏳ Timing violations—missed deadlines, stale investigations, or post hoc justifications stitched after decisions.

- 🧪 Record gaps—absence of granular HS‑line analysis, ignored less‑restrictive alternatives, or insufficient interagency sign‑off.

- 🧱 Country discrimination lacking rational basis or tied to animus rather than evidence.

- 📉 Economic harm and standing—importers show liquidated entries and higher costs; retailers cite lost shelf space and return spikes; consumers argue pass‑through.

🛡️ How the government will defend

- 📜 Text & history—Congress has repeatedly delegated trade authority in 232/301/IEEPA for dynamic threats; Algonquin approves wide latitude under 232.

- 🧭 Foreign affairs deference—courts avoid micromanaging national security determinations and give the Executive presumptive space to act.

- 🧰 Process sufficiency—administrative records, even if concise, show consideration of evidence, alternatives, and interagency views.

- 🧪 Tailoring—use of TRQs, exclusions, and periodic reviews prove proportionality.

- ⏳ Mootness/ripeness—if measures evolve or sunset, challenges may be moot or unripe, shrinking justiciable windows.

🧮 📅 Comparison — who has standing, and how strong is it?

| 👤 Plaintiff type | 🧾 Typical injury pled | 🧪 Relative strength |

|---|---|---|

| Importer/Brand | Duties paid, canceled POs, lost customers | High—direct, quantifiable |

| Retailer/Assoc. | Margin compression, promo cuts, shelf loss | Medium—causation contested |

| Consumer group | Higher prices, lower quality/choice | Low‑Medium—traceability hard |

🧠 Procedure and timelines: what happens when

Typically, it opens with a summons and complaint at the CIT, often accompanied by a motion for a preliminary injunction to stay collection against future entries. Courts consider irreparable harm — a hard bar, when money can be refunded later. The case then proceeds through the compilation of a record, briefs on statutory authority, APA‑style reasoned-decision arguments, and perhaps constitutional claims. Oral argument is routine; a panel ruling can be months in the making. If the plaintiffs win, remedies vary from remand without vacatur (the agency has to fix its reasoning while the tariffs remain) to vacatur (tariffs expire). “We review the [above] findings of fact only for substantial evidence, the legal standards de novo.” The Supreme Court, true to form, rarely gets involved in the world of trade unless there is a circuit split or a huge constitutional issue at stake — but the big questions posed raise the stakes a bit if the case manages to cast a genuinely grand separation‑of‑powers fight.

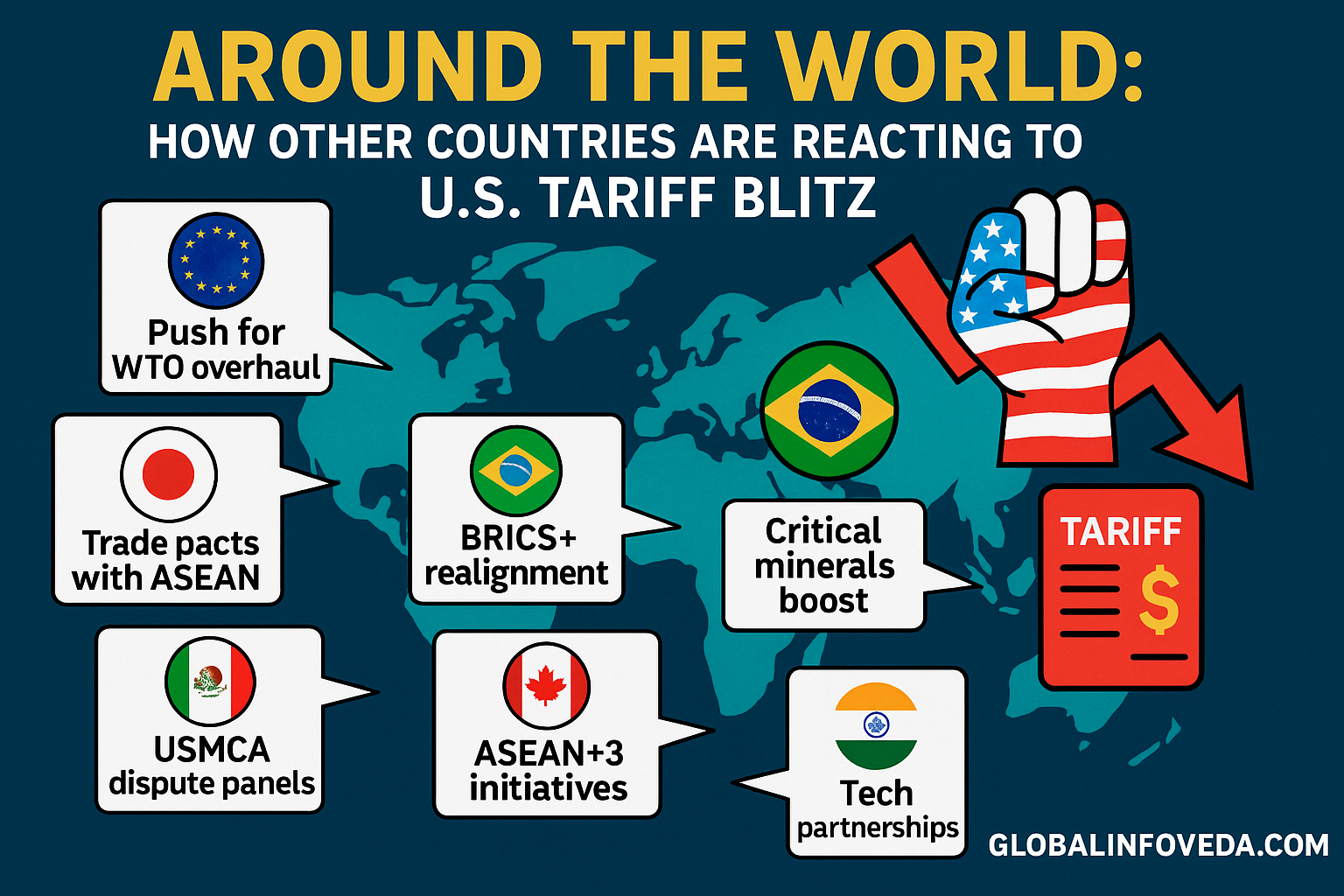

Systemic effects perspective: Global Realignment—Tariff Wars Fuel Decoupling of Financial Systems

🧪 Hypothetical fact patterns courts would scrutinize

A statement that a vast range of consumer electronics, clothing and home goods are “security”-threatening under 232, absent detailed supply-chain information or explicit tie to the defense industrial base, invites suspicion. A sweeping 301 action based on “persistent trade imbalances” as opposed to IP theft or forced tech transfer appears to be fiscal policy by a different name. An IEEPA emergency activated pursuant only to generic “economic warfare” language with no time‑bounded criteria might raise significant questions. In each case, challengers will pose a blunt question: did Congress clearly give the go-ahead for this scale and this logic, or is the Executive drawing the power to shape the world in ways of immense importance from ambiguous text?

🧠 The WTO and international‑law backdrop

While domestic courts will be interpreting U.S. statutes, panels and, if operational, successor AB‑process panels may be entertaining complaints involving GATT preservation‑related GATT‑violations and misuse of safeguard actions or invocation of national security pretexts. The U.S. has maintained that security exceptions are self‑judging; some recent panel views have nudged for some good‑faith limitations. WTO rulings are not binding on U.S. courts, but they inform diplomacy and can allow retaliation within the rules, changing the strategic calculus. A domestic court hesitant to police foreign affairs might still read statutes narrowly to prevent international friction, a canonical construction move when text permits.

Why consumers matter in the calculus: Who Wins? How U.S. Tariffs May Backfire on USA Consumers

🧰 Practical implications for India and cross‑border partners

If courts do pare down Liberation Day tariffs, Indian exporters in apparel, jewellery, auto‑components, seafood and specialty chemicals would receive faster relief than diplomacy alone could offer. If courts remand without vacatur, businesses should prepare for a sprint to document — to increase the traceability of Origin, to demonstrate compliance with environmental and labor standards, and to lock-in AEO benefits so customs risks go down. If most measures are upheld, India’s optimal response is still diversification to the EU, GCC and Japan, buttressed by standards diplomacy and product dual‑spec design to protect foreign shells. (®Mint) Treasury teams micro‑layer FX hedges; widen receivable discounting channels; publish first‑pass yield and DSO dashboards to keep lender confidence through litigation noise.

🧠 Communication: why clarity can lower legal risk

Courts listen for reasoned explanations. Agencies that introduced dashboards — HS‑line rationale, expected price effects, carve‑out criteria — and agreed to sunset reviews appear more credible. The same holds true for companies: consumers respond to clean spec maps and the disclosure of lifecycle costs that demonstrate why a $19.99 peg stays honest and doesn’t exhibit any of the hidden quality drift. When there is a lot at stake in the litigation, ambiguity costs money. Clarity and predictability squeeze the risk premia priced into contracts and alleviate the legal optics of arbitrariness.

🧠 FAQs for executives, counsel, and policy teams

- ❓ Can a court strike down tariffs as “unconstitutional” outright? Yes, but most wins are narrower—statutory overreach, missed deadlines, or inadequate records leading to remand. A pure nondelegation win is rare.

- ❓ Does the “major questions doctrine” apply to tariffs? If the action reshapes a large swath of the economy using ambiguous text, challengers will argue it does. Government will reply that trade and security delegations are classic and specific, not creative expansions.

- ❓ Could consumers or states sue directly? Standing is hard. Importers and brands with duties paid have the cleanest path. States might try parens patriae theories, but success varies.

- ❓ What happens to duties already paid if tariffs fall? If entries are unliquidated, refunds are straightforward. If liquidated, recovery is harder; procedural posture matters.

- ❓ How long will the fight last? Expect 12–24 months through CAFC; Supreme Court review only if a broad constitutional question or split emerges.

🧮 🔭 Comparison — outcomes spectrum and business planning

| 🎯 Outcome | 🧭 Legal reasoning | 🧰 Business takeaway |

|---|---|---|

| Upheld | Clear statutory fit; reasoned record; tailored remedy | Plan for permanence; invest in standards and alternate corridors |

| Remand no vacatur | Process gaps but court defers to agency to fix | Keep compliance sprint; hedge FX; avoid capex until clarity |

| Vacatur | Ultra vires or major questions problem | Reprice contracts; pursue refunds; rebuild U.S. shelf strategies |

🧠 Personal analysis—how a court might frame the decision

A pragmatic court could navigate the gap between maximalist positions. Look, in response, for language affirming Congress’s historic delegations in trade and security, coupled with a sober, in-your-Eyeore insistence on process discipline and tailoring. A blessing for measures that target those that have genuine link to security or unfair practices together with a caution that open‑ended industrial policy dressed in trade guise raises very large questions of trouble. The lesson for agencies, he writes, would be to include detailed records, define carve‑outs with objective criteria, respect deadlines and provide sunset reviews. For business, assume only partial durability; build flexibility into contracts and supply chains rather than assume that it’s all going to collapse or all going to sit tight indefinitely.

Consumer‑side lens to balance the debate: U.S. Families Could Pay $3,800 More a Year Due to Tariffs

🧠 Local relevance—what Indian states and clusters can do now

- 🧪 Traceability labs in Tiruppur/Surat/Rajkot so exporters can certify inputs quickly when U.S. agencies tighten origin checks during litigation.

- 🚚 Shared freight desks in knitwear and seafood clusters to cut volumetric weight and lift container fill; lenders reward predictable logistics during legal uncertainty.

- 🧾 AEO enrollment drives run jointly by state export promotion councils and customs brokers; faster clearance offsets tariff headwinds.

- 🧰 Design pods for dual‑spec SKUs (value/premium) to hold export retail pegs in EU/Japan while U.S. orders are noisy.

- 💱 Hedge literacy workshops for MSMEs—layered forwards, invoice currency choice, and netting basics.

📚 Sources

- U.S. Constitution Annotated (Congress.gov) — Commerce Clause, Taxing Power, and delegation analysis: https://constitution.congress.gov/

- Congressional Research Service (CRS) — primers on Section 232, Section 301, and IEEPA authorities: https://crsreports.congress.gov/

- U.S. Court of International Trade — rules, jurisdiction, and recent opinions: https://www.cit.uscourts.gov/

- World Trade Organization (WTO) — dispute settlement and national security exception notes: https://www.wto.org/

🌟 Final Insights

Whether those Liberation Day tariffs are ultimately unconstitutional will hinge less on slogans and more on the statutory scaffolding and process hygiene underneath them. Courts are not going to erase longstanding trade delegations but they can and do require tailoring, deadlines, and reasons givings that loosely bind remedies to an aggravated harm. That’s books of granular HS‑line logic, objective carve‑out criteria and time‑boxed sunsets, to satisfy policymakers. For companies, it implies preparing for partial durability—tighten compliance, diversify corridors, micro‑hedge FX, and develop dual‑spec products which defend shelf logic across multiple markets. If the legal system prunes excess and keeps the legitimate tools, the result could be a smarter, less erratic trade stance that shelters households and supports commerce.

👉 Explore more insights at GlobalInfoVeda.com