🧭 Introduction

The term “tariff anxiety” has jumped from economic doldrums to dinner-table reality for working class American families in 2025. What may seem as a remote policy fight lends itself at home to higher consumer prices, tinier paycheck-to-paycheck margins and new decisions on what to fix, what to hold off on and what to just forgo. Unlike earlier cycles, the current one mingles sporadic import duties with prolonged supply‑chain frictions, more expensive credit and a glut of mixed signals — from retailers that vow to make “price investments” to central banks that preach patience. This guide disentangles how tariffs claw their way through the system, why the effect is regressive on lower incomes, what a couple of behavioral traps are that make the bills worse, and some of the counter‑moves that in fact insulate the wallet. It is modeled on field practices used by grocers, repair networks, warehouse clubs and community programs that have found ways to keep essentials within reach even as headline shocks grab at the news. The goal is practical clarity: Understand the mechanics, and then pull the levers you control — timing, maintenance, substitution, and neighborhood resilience in your own life — even as you push for targeted relief from policymakers who should be thinking about how to deliver some instead of providing a spectacle.

Meta description: In 2025, tariff anxiety hits working‑class U.S. families hardest. Learn what drives the squeeze—and precise steps to lower household costs fast.

📌 What “tariff anxiety” means for working‑class households

Tariff anxiety claime an experience: not only are prices higher, but the steadiness of essentials feels less solid as well. For working‑class families — with less savings and more vulnerable to tradables such as clothing, appliances and basic electronics — the pass‑through from import duties lands fast and can stick. The shock radiates beyond shelves. Auto repair bills climb up because the parts have become more expensive; childcare fees edging higher as centers replace imported consumables; renters facing longer waits as owners of buildings cope with higher fixture costs. All of this is overlaid with credit card APRs that can turn small amounts into nagging leaks, so the whole thing feels like a naked pinch. Yet the pinch is not destiny. If households and retailers rally around maintenance‑first, private‑label quality, unit‑price literacy and anchored promo windows, much of the sticker shock will convert into savings and longevity instead of debt.

🛒 Where the squeeze shows up first in 2025

- 🧾 Groceries: Imported oils, canned fish, certain grains, and global snacks creep up. Private‑label equivalents and recipe swaps blunt the rise without quality loss.

- 🧰 Home repair: Faucet cartridges, motors, small pumps, and LED drivers cost more. Preventive maintenance avoids cascading failures.

- 📱 Electronics: Laptops, tablets, and peripherals track higher when semiconductor boards or batteries face duties. Certified refurb and extended warranty strategies stabilize spend.

- 👖 Apparel/Footwear: Entry‑tier pegs break first; brands test twin‑spec designs to hold headline prices while trimming non‑core features.

- 🚗 Mobility: Tires and brake kits feel tariffs faster than fuel. Keeping alignment and rotation schedules saves triple later.

- 🧒 School supplies: Device accessories and imported craft items add up. Buy‑back lanes and pooled district procurement help.

Deep dive on consumer incidence: Who Wins? How U.S. Tariffs May Backfire on USA Consumers

🧮 🔗 How tariffs become prices: three transmission lines

| 🔗 Transmission line | ⚙️ What changes in the chain | 🧾 What a family actually experiences |

|---|---|---|

| Direct duty on finished goods | Import cost jumps at the dock | Shelf tag rise or smaller pack at same tag |

| Input pass‑through | Duties on parts/ingredients lift factory cost | Same model with spec tweaks; fewer promos |

| Friction/finance | Port dwell, re‑routing, higher working‑capital cost | Stock‑outs, limited models, slower warranty service |

🧠 The behavioral piece: how anxiety inflates bills

Decision bandwidth is a defining characteristic of working-class families. And when the future grows uncertain, people often defer maintenance to the point of failure, stockpile quantities of perishables or pursue “deal” signs that are shadows of price‑per‑unit increases. Retail psychology makes it worse: It’s hard to convince shoppers not to buy when they’re burying quiet money-saving gifts such as filters, belts, gaskets and seals that keep appliances alive under loud promos for discretionary toys. Given tariff anxiety, there’s also replacing repairable gear because, “well, we have everything up anyway,” a vicious cycle that leads to the landfill and the bills. The antidotes are straight-forward and potent: calendar-keeping sprints, practice unit math, favor refill apps and settings, and select brands/retailers that provide spec cards for entry‑tier products. Each step takes back control and reduces the punishment that policy volatility seeks to inflict on lower‑income households.

🧰 Ten wallet‑saving moves tailored to working‑class realities

- 🗓️ Anchor your buying calendar to real promo windows (back‑to‑school, Black Friday). Predictable beats impulsive.

- 🔧 Maintenance first: oil changes, HVAC filters, wiper blades, tire rotations—cheap now, expensive later.

- 🛒 Private‑label pivot where quality is proven; many are co‑manufactured with national brands.

- ♻️ Refill culture: cleaners, soaps, and certain pantry staples run cheaper per use in bulk/refill formats.

- 📏 Unit‑price literacy: compare per‑ounce/gram/serving; don’t pay for cosmetic “newness.”

- 💳 APR detox: consolidate small balances, avoid store‑card traps; interest costs destroy savings.

- 📱 Certified refurb for school/work devices; prioritize long OS‑update windows and standard ports.

- 🧰 Repair networks: support local shops; ask for photo‑documented diagnoses to prevent upsells.

- 🧾 Two‑bucket basket: essentials vs nice‑to‑have; the second bucket flexes when prices spike.

- 🧠 Spec cards, not slogans: trust retailers that share materials, warranty terms, and build quality.

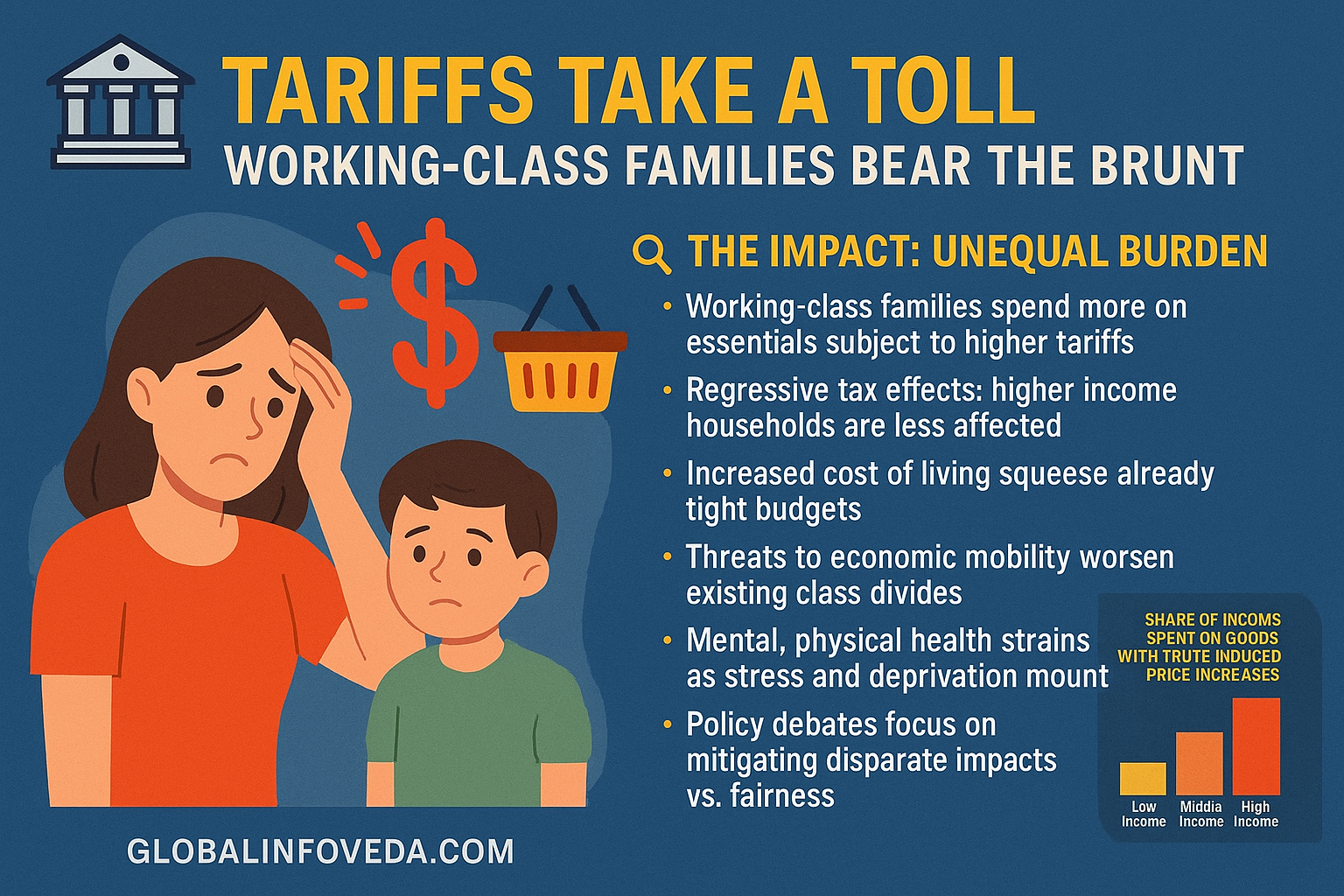

🧭 Why the burden is regressive—and what makes it so in 2025

The regressivity springs from exposure and optionality. The typical working‑class household devotes a greater share of its budget to tradables where tariffs take a bite, has far fewer substitutes and limited ability to pre‑buy when goods go on sale. Geography complicates things: Metro areas near a port might see faster pass‑through on imported perishables; car‑heavy regions feel auto parts inflation; colder states experience utility spikes when HVAC consumables cost more. Another 2025 curveball is the cost of credit: higher APRs make a little delay turn into compounding cost. Finally, services take a while to absorb goods inflation — haircuts, dental, daycare — so the second wave comes as households run out of easy savings. The policy response is surgical relief, not blunt force: time‑boxed TRQs on staples, standards fast‑tracks for compliant suppliers, and municipal programs to expand repair access and tool libraries.

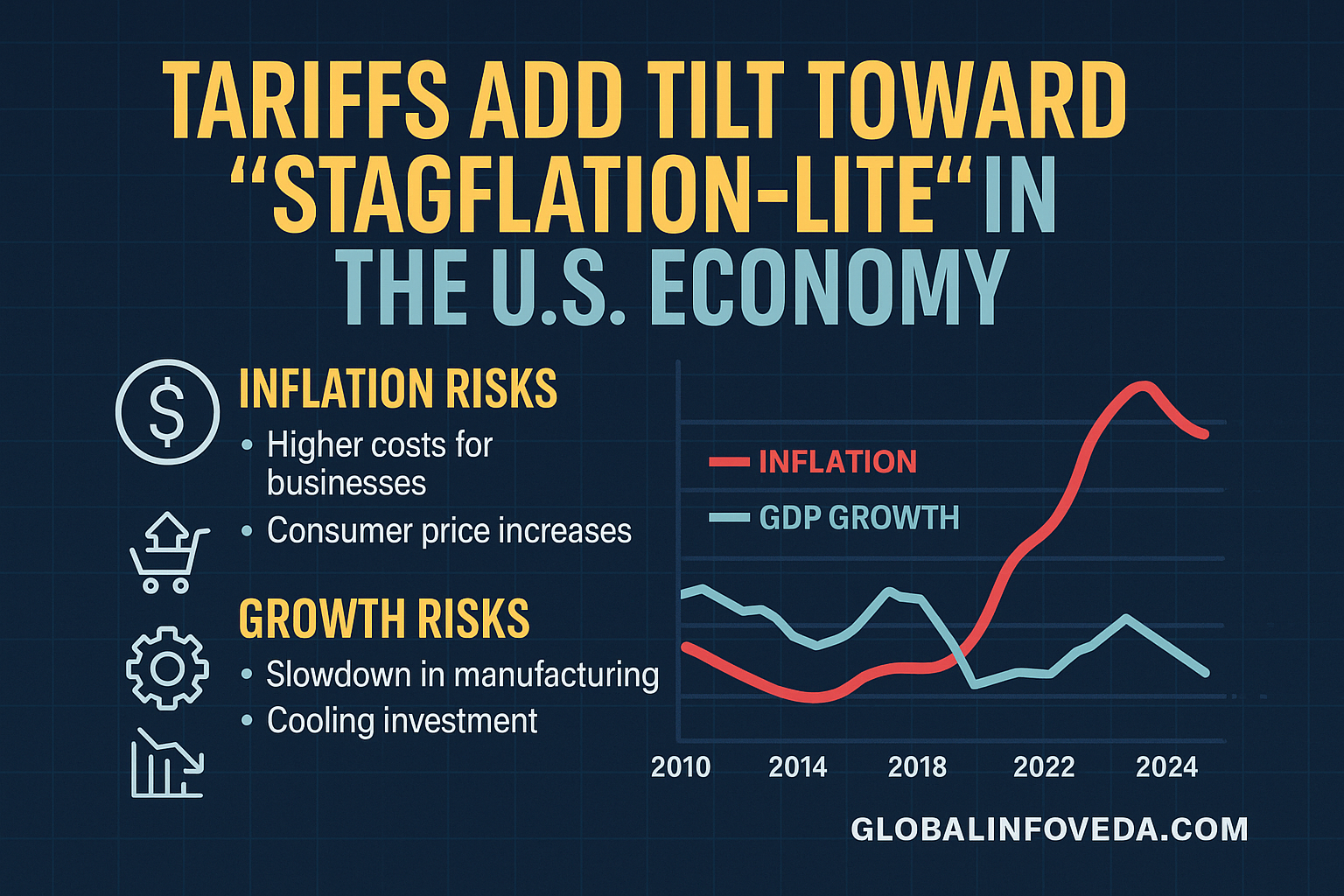

Macro design to avoid sticky pain: Stagflation‑Lite in the U.S. Economy

🏭 Paychecks vs prices: what’s really happening on wages

Wage numbers that lead the merry-go-round can hide local reality. Wages rose in many counties on an hourly basis, if overtime declined, or if shifts were staggered were balanced out and they still took home flat. It obscured no baseline increases were occurring. On the other hand, benefit costs and transportation costs rose. For working‑class families the net is nowhere—especially when tariff‑linked categories like apparel, tires and small appliances as a percentage of the paycheck swallow more whole than ever. Employers can help by providing predictable schedules and maintenance stipends — $100 toward filters and belts will save workers multiples that amount by preventing breakdowns. Policy makers can continue to keep credit lines open for small importers and repair shops, minimizing the domino effects that land in household budgets.

🧮 📊 Side‑by‑side—income tier, exposure hot‑spots, and best first move

| 💵 Income tier (illustrative) | 🎯 Exposure hot‑spots | 🧰 Best first move |

|---|---|---|

| $30k–$55k | Groceries, apparel, auto parts | Private‑label pivot; maintenance sprint |

| $55k–$90k | Electronics, home repair, daycare | Certified refurb; unit‑price checks |

| $90k+ | Premium appliances, imported autos | Warranty strategy; schedule big buys |

🛍️ How retailers can be the quiet heroes in a tariff year

- 🧾 Entry‑tier integrity: publish spec cards; no stealth shrink; honest materials.

- 📦 Assortment discipline: fewer, deeper SKUs to negotiate better and stock reliably.

- 🚚 Milk‑run logistics: cluster pickups to cut damage and dwell; publish route scorecards.

- 🧪 Audit speed: clear replacement suppliers quickly so shelves don’t go thin.

- 🔧 Service bundles: filters, belts, and batteries promoted with reminders—saves customers more than flashy gadgets.

- 🏷️ Promo calendar clarity: repeatable windows families can plan around; short, meaningful discounts.

🧪 Case study—Cleveland grocer holds line on staples without stealth shrink

A union‑friendly regional grocer refused to cut pack sizes in 2025. Instead, it re‑engineered cartons (flute, burst strength), reduced duplicate SKUs, and built a refill aisle for cleaners and personal care. It posted spec cards on private‑label oils, rice, and canned goods, and shared quality labs’ results in‑store. Entry‑tier pegs held; basket sizes stabilized; damage returns fell 18%. The chain earned long‑term loyalty by treating working‑class families as partners, not targets.

🧪 Case study—Detroit repair co‑op beats parts inflation

Independent mechanics set up a purchasing co‑op to acquire filters, belts and brake kits in pooled lots. They made photo‑based diagnostics to reduce dispute time and published turnaround SLAs standard. This saved households between 12-20% over the solo‑shop price, sidestepped high dealer markups, and prolonged the life of their vehicle during a time when tariffs lifted OE parts up. The co‑op’s most triumphant: predictable alignment/rotation packages that prevented tire blowouts—as much a safety win as a money save.

🧮 Budget math: why the “$3,800 hit” is an average, not a fate

The headline $3,800 estimate represents an average household, and working‑class families may drastically swing the results. A 12‑week maintenance sprint (filters, seals, wipers, oil), a 10‑unit private‑label trial (of 10 staples), and LPM‑certified refurb device choice can shave $1,500–$2,200 off anticipated exposure—before policy relief. The spread is broad because behaviour trumps average: timing big buys to pegged promos and continuing to demand honest entry‑tier specs nullify a shocking amount of passthrough. Community programs — repair cafes, tool‑libraries, and school device buy‑backs — multiply returns by reducing the fixed cost of resilience.

Extended household playbook: U.S. Families Could Pay $3,800 More a Year Due to Tariffs

🧮 🧰 Policy tools that help—and how they feel at checkout

| 🧰 Tool | 🧭 Intended effect | 🧒 Checkout‑level feel |

|---|---|---|

| TRQs on staples | Cap shock on oils, grains, dairy | Stable basket; fewer “surprise” spikes |

| Standards fast‑track | Speed clearance for compliant goods | Fewer stock‑outs; reliable models |

| Port dwell dashboards | Reduce hidden friction costs | Shorter waits; predictable deliveries |

🧠 Services inflation: why the second wave hurts

Prices for haircuts and dental cleanings and daycare have coiled higher after goods because businesses initially absorb import‑linked costs on equipment and supplies and then hike fees. There is also wage pressure on providers in 2025 as retail shifts becomes the new normal. Working‑class families can hedge by signing up with transparent membership plans, by supporting clinics that use refurbished equipment and by timing regular care in off‑peak months. City leaders can assist with bulk buys for community clinics and with price‑integrity dashboards that compensate providers who keep their fee structures honest as inputs gyrate.

When the non‑tradable side slows: U.S. Services Sector Nears Standstill Amid Tariff Pressure

🌐 Global spillovers that loop back to the U.S. wallet

Tariffs reshuffle shipping lanes and supplier rosters. Unit costs can jump initially, but if reliability is gained, the upward curve tends to come down quickly, particularly if production is moved to friendly ‑ shoring hubs. Pairs in trade‑exposed countries gyrate, introducing FX noise to the cost of imports. Commodity exporters reprice, food and fuel price-hikes rotate. For working‑class families, the practical effect is more randomness: One brand disappears, one model switches ports, one warranty part is more delayed. The mitigation is boring but also effective — choose brands that offer repairability, demand standard ports and parts and support retailers who publish spec cards and avoid stealth shrink. Better standards and audit systems tend to contain prices over the medium run, but the risk is whether wealth managers can survive the transition.

Financial plumbing angle: Global Realignment—Tariff Wars Fuel Decoupling of Financial Systems

🧠 Myths that raise the bill—and what’s accurate

- 🧨 Myth: “Everything is more expensive, so timing doesn’t matter.”

✅ Reality: Anchored promo windows deliver real savings; planning beats panic. - 🧴 Myth: “Private‑label is low quality.”

✅ Reality: Many are co‑manufactured; spec cards prove parity. - 🛠️ Myth: “Repairs are sunk costs.”

✅ Reality: In tariff years, maintenance yields the best ROI and reduces emergencies. - 📦 Myth: “Shrinkflation is unavoidable.”

✅ Reality: Honest net‑quantity labeling earns loyalty; vote with your basket.

🧭 Neighborhood systems that shrink bills

- 🧰 Repair cafes hosted by libraries or community centers extend appliance life.

- 🧱 Tool libraries let renters tackle fixes without big upfront spend.

- 🧴 Refill stations for cleaning and personal care cut per‑use cost and plastic.

- 📚 Device checkout from libraries fills school gaps; bulk buys standardize chargers/spares.

- 🧑🍳 Recipe clubs build menus around affordable substitutes when imported items spike.

🧪 Case study—South Texas school district’s device plan

A district facing higher tablet prices pooled procurement, adopted a minimum OS‑update window, and stocked common spares. Families tapped a buy‑back lane at year end. Result: per‑student device cost fell over two years, even with tariffs. Teaching time lost to tech failure dropped; parent fees stayed predictable.

🧭 90‑day action map for households

- Weeks 1–2: Maintenance sprint—filters, wipers, seals, oil, tire rotation; label next due dates.

- Weeks 3–4: Subscription audit; cancel low‑utility auto‑renews and redirect to emergency fund.

- Weeks 5–8: Private‑label trials for 10 staples; track quality; lock winners.

- Weeks 9–10: Device strategy—consider certified refurb; check warranty and OS support.

- Weeks 11–12: Promo‑aligned restock; avoid panic bulk that strains cash flow.

🧠 Personal analysis: why precision beats spectacle

The policy temptation is always to respond to loud tariffs with louder counter‑tariffs. That seldom brings a working‑class bill down. Sensible actions: TRQs where incidence is high, standards that better reward true quality, port performance measures that reveal friction costs and credit support that helps the little guy stocking his community. Retailers succeed when they simply hold their entry tier with clear specs and invest in carton engineering that will raise container fill. Families win by concentrating on what compounds in their favor: maintenance, refills, unit‑price literacy and timing. Anxiety subsides when systems behave predictably; it’s making that predictability that’s the joint project for 2025.

🧭 Regional cost patterns—how place shapes pain for working‑class families

For working-class U.S. families, tariff jitters pass through the filter of local realities: wages and commute modes, the type of housing stock, the weather. In West Coast metros, a bigger share of food miles and apparel imports means consumer prices are more sensitive to port congestion and dwell delays; in Great Lakes towns, the hit skews toward auto parts, tools and small motors linked with production supply chains. Sunbelt metros feel it via tires, AC consumables and longer car commutes, Northeast cities carry more import exposure on apparel and home goods but enjoy transit buffers on fuel spikes. Rural counties, with used cars and DIY repairs the only options for working‑class families, have longer waits for parts, fewer retailer choices — and a greater risk of price discrimination when one store is everything. Understanding these patterns enables local leaders and businesses to triage: bulk‑purchase brake kits in car‑heavy areas; publish price‑integrity dashboards in food‑import hubs; scale up tool libraries where donated rental stock is scarce. If geography is not destiny, it is a map for smart defenses against tariffs.

🛡️ Safety‑net intelligence that actually lowers out‑of‑pocket spend

- 🧾 Utility relief: enroll in budget billing and weatherization grants; small co‑pays now avert winter spikes later.

- 🫶 Community care cards: some nonprofits issue repair vouchers for essential appliances; ask libraries and faith groups.

- 🩺 Clinic memberships: transparent monthly plans for primary care beat per‑visit sticker shock when inputs rise.

- 📦 Warehouse share clubs: neighbors split bulk buys to avoid expiry and freezers overfull with waste.

- 🧰 Tool library tiers: advanced kits (torque wrenches, multimeters) made available with quick training.

- 🚘 Transit trials: discounted passes during peak tariff months help car‑dependent workers redirect cash to repairs.

🧩 Renters vs homeowners—different exposures, different shields

Renters in 2025 assume a stealth burden from tariffs when landlords take their time replacing fixtures or simply pass on the cost through fees. They don’t have as much storage and do not allow for bulk refills, undermining a vitally important defense. Homeowners are hit harder with one‑off item costs —HVAC parts, roofing consumables — but can recoup savings through maintenance or energy upgrades. The savviest community interventions address these exposures one by one: apartment‑focused repair cafes that instruct residents in seal replacement and faucet cartridge swapping; building‑owner competitions that incentivize maintenance at that inflection point of cost and convenience; city‑backed micro‑grants for high‑impact fixes (weather‑stripping, LED retrofits) that knock more off the monthly outlay of a working‑class household than any coupon ever could. For both factions, the more insistent demand that people resist that impulse in their new purchases” standard ports, common spares “beats brand slogans and softens the pass-through from import duties to monthly bills.

🍎 Food basket redesign for 2025 without losing nutrition

- 🫘 Protein swaps: rotate beans, eggs, and canned fish depending on weekly price swings; lock a base recipe that flexes.

- 🌾 Starch ladder: rice, pasta, potatoes—choose on unit‑price this week, not habit; keep one backup in the pantry.

- 🥫 Canned strategy: focus on varieties unaffected by duties; accept store brands with clear spec cards.

- 🧂 Flavor bank: bulk spices in refill jars replace branded mixes; cents saved accumulate across months.

- 🥦 Frozen vs fresh: frozen vegetables dodge seasonal shocks and reduce waste; buy fresh when unit‑price aligns.

- 🧃 Drink rethink: water, tea, and powdered mixes beat single‑serve beverages whose packaging tax rises when inputs do.

🔌 Energy bills when everything else is up

The only satisfactory reduction in a tariff year is the kilowatt you never use. Cheap measures are better than gadget splurges for working‑class U.S. housing stock: door sweeps, weather‑stripping, LED bulbs, and a simple water‑heater temp check. The effects of these moves snowball from season to season and cushion the budget when consumer prices unexpectedly spike elsewhere. And if a utility has demand‑response credits, then enrolling gives us a tiny, but guaranteed, reduction. Stay away from high‑ticket solar or HVAC replacements on “deal” whispers—they can wait until you’ve gone through the house and made sure the insulation is up to code, you’ve audited your HVAC, or taken a look at whatever rebates are available in local, written form. Households who account for energy like a fixed project, not a mystery, finish the year with real cash — just as tariffs try to get it.

🚦 Transport costs: where tariffs hide in your commute

- 🚗 Tire life: rotations every 8–10k miles and proper alignment out‑save almost any fuel hack when tire prices rise.

- 🛞 Brake kits: bundled pads/rotors purchased in pooled lots beat emergency, single‑axle retail prices.

- ⛽ Fuel timing: consistent fill routine avoids price spikes; loyalty programs can be worth it only if you avoid detours.

- 🚌 Transit and car‑pool: even one day a week off the odometer redirects money to maintenance.

- 🧯 Breakdown prep: jump starter, compressor, and sealant save a tow—small kit, big savings when parts are scarce.

🧑⚕️ Health costs under tariff pressure—what to do before fees rise

Providers have to deal with more expensive consumables and equipment. In advance of the fees reset, families can extract value by timing checkups, haggling for bundled cleanings and selecting clinics that post sterile‑supply surcharge, in place of, rather than burying them. For maintenance items — orthotics, braces, nebulizers — check on refurbished options that come with warranties. Pharmacies with transparent generics lists and 90‑day fills help to reduce per‑dose cost even when packaging inputs spike. The principle is straightforward: Get planned care out in front of you now and standardize it where in any way possible so that second‑wave services inflation does not crash up against your high‑expense months.

💳 Debt, APRs, and why a small balance becomes a big leak in 2025

As those tariffs squeeze budgets, tiny credit balances quietly bloat under higher APR. The lowest‑risk fix, for working‑class households, is structure: one payment day a month, auto‑pay above minimum, and a hard rule against new store cards. Avalanche (highest APR first) beats debt snowball when interest rates are high. If a union or credit union or a community bank offers small‑balance consolidation at a capped rate, get revolving debt into installment format to stop the bleeding of cash flow. The cost of the alternative — letting balances ride while trying to chase promotions — wipes out the savings you worked to create as you were paying down with maintenance and private‑label pivots.

🧰 DIY skill ladder—small fixes that prevent big bills

- 🔧 Door & window seals: cut drafts, protect HVAC; cheap, quick, and high return.

- 🚿 Faucet cartridges & flappers: end leaks that become water‑bill tax; parts are low‑cost and widely stocked.

- 🧼 Appliance hygiene: clean coils, gaskets, and filters; performance improves, lifespan extends.

- 🪫 Battery discipline: standardize AA/AAA brands; buy chargers where sensible; avoid odd sizes that spike during shortages.

- 🖥️ Device care: cases, screen protectors, and surge strips delay replacements when electronics prices rise.

🧑🏫 Employers, unions, and colleges—micro‑policies that help now

Unions and HR departments can head off tariff anxiety with real benefits: steady schedules, commuter subsidies and maintenance stipends connected to products like filters/wipers that stave off car breakdowns. Colleges can create more laptop‑loaner pools with open OS‑update windows and push out a standard, low‑cost accessories list to eliminate predatory campus bundles. When institutions account for working‑class limitations as design inputs — not as afterthoughts — attrition drops and outcomes improve, even in a high‑friction year.

🧠 Children’s costs—keeping learning and joy intact under price pressure

For families with children, the budget narrative is not just devices and shoes. It’s not the tests or homework that shape what a year feels like, it’s the birthday parties, the extracurriculars and the field trips. Tariffs also increase the cost of craft kits, sports gear and even bus contracts. The antifragile response is substitution by design: library maker days instead of boxed kits; community sports with kit‑share closets; family subscription swaps (one streaming service at a time). Above all, match school device choices to their ease of repair or continued operating system support so that a cracked screen or dead battery doesn’t lead to a budget crisis. Childhood doesn’t need to shrink just because consumer prices grew — what does need to change is how we obtain.

🧠 Stress and decision fatigue—how to keep anxiety from making bills worse

One underrated cost of tariff anxiety is the cognitive load. Decision fatigue is pushing people toward the convenience buy and “deal blindness.” Bringing back a routine is a savings engine all its own: one shopping day, one maintenance day, one hour of admin per week for bills and returns. Pre‑plan three alternatives for every volatile item (one oil, one grain, one protein). Automate price tracking on essentials: Mute promotional noise that tempts you to discretionary spend. Colocation-shared household dashboards, whether whiteboard or notes app, convert worry into a checklist. A structured stress, and the budget is breathing again.

🧠 Scenario map for the next 12 months—what to watch and how to react

Base case (most likely): tariffs stay elevated but predictable; retailers adapt with spec transparency and private‑label depth; households that ran maintenance early see stable outlays.

Upside: targeted TRQs and standards diplomacy ease shelf pressure; port metrics improve; select categories roll back prices. Response: move dormant replacements forward.

Downside: renewed trade flare‑ups and port disruption; FX swings raise import costs; services raise fees. Response: freeze discretionary bucket, double‑down on repair and refill.

🔍 Buying guides that beat sticker shock

- 📱 Phones & laptops: prefer models with long OS‑update windows and standard ports; certified refurb with two‑year warranty is often superior to new budget lines.

- 🧰 Appliances: check coil access, filter availability, and third‑party parts; avoid proprietary consumables.

- 🥾 Footwear: choose resolable or well‑reviewed construction; insoles and maintenance extend life.

- 🧥 Apparel: focus on fabric durability and care simplicity; avoid novelty trims that fail first.

- 🔌 Small electrics: replace cords before devices; keep dust out; buy brands with published exploded‑parts diagrams.

🧭 Local leader playbook—small levers, fast wins

- 🗺️ Price‑integrity dashboards for staples in municipal markets; reward transparent retailers.

- 🧰 Repair fairs quarterly with volunteer techs; measure devices saved from landfill.

- 🔋 Battery & e‑waste days that include repair advice; prevent costly, unsafe improvisations at home.

- 🚍 Transit flash passes during peak inflation months to offset auto parts spikes.

- 🧑🏫 School procurement compacts for long‑support devices and standardized chargers.

🧠 FAQs

Is it smart to switch to cash to “feel” spending? For some, yes—but not at the cost of missing card‑based price protection or warranties. Use a hybrid: cash envelopes for flexible categories, cards for protected essentials.

Do import labels like “assembled in Mexico/Vietnam” guarantee lower duty exposure? Not necessarily; rules‑of‑origin are complex. Buy on repairability and warranty rather than passport.

How do I detect stealth shrink without obsessing? Track a handful of staples’ net quantity in a note once; recheck quarterly. Vote with your basket when specs slide.

Can community gardens really matter to a family budget? Yes—herbs, leafy greens, and shared cooking events meaningfully reduce spend and improve nutrition where prices are volatile.

What one move would you pick if you could only do one? A maintenance sprint—it prevents the most expensive emergencies in a tariff year.

Do “Made in USA” labels avoid all tariff impact? Not fully. Many goods include imported components. Choose repairability, warranty, and honest specs over slogans.

Should I stockpile when prices rise? Store only what you’ll use; expired goods erase savings. Prefer refills and durable goods with long support windows.

Are warehouse clubs always cheaper? Scale helps, but unit‑price math and expiry still rule. Don’t overbuy perishables.

Is gold a household hedge? Gold ETFs can stabilize portfolios, but emergency cash and maintenance deliver immediate, usable savings.

Will prices fall if tariffs pause? Some will, but contracts and friction costs can keep tags sticky. Transparency and competition are the real brakes.

📚 Sources

- U.S. Bureau of Labor Statistics (BLS) — CPI composition and item weights: https://www.bls.gov/

- U.S. Trade Representative (USTR) — tariff actions and explanatory notes: https://www.ustr.gov/

- Congressional Budget Office (CBO) — research on trade policy and consumer impact: https://www.cbo.gov/

- International Monetary Fund (IMF) — pass‑through and inflation analyses: https://www.imf.org/

🌟 Final Insights

The roar of the tariff anxiety, but also the whisper of the solutions: maintenance, private‑label quality, unit‑price literacy, and predictable promo calendars—magnified by retailers who guard the entry tier and by policymakers who select TRQs, standards fast‑tracks, and transparent port dwell dashboards over theatrics. If working‑class U.S. families concentrate on small compounding wins and communities back repair culture, a chaotic 2025 becomes a year of skill‑building and budget relief, not a descent into resignation. For working‑class U.S. families concerned about tariffs, the din of anxiety can mask a quieter truth: The strongest shields come from predictable, boring habits. When households run a quick maintenance cycle, pivot to proven private‑label staples, demand spec transparency, and time durable purchases against legit promo calendars, the year’s inevitable shocks are absorbed by systems, not by panic. Those retailers that protect entry‑tier integrity but run optimization on cartons, routes, and audits, are partners rather than enemies. City leaders who publish port dwell and price‑integrity metrics help lift the fog that breeds resignation. And when unions, colleges and clinics organize around repairability and long‑support gear, the compound effect is dignity — the ability to say “we’ve got this” even when policy drama blares on all screens. That is the silent victory on offer in 2025.

👉 Explore more insights at GlobalInfoVeda.com