🌍 Introduction

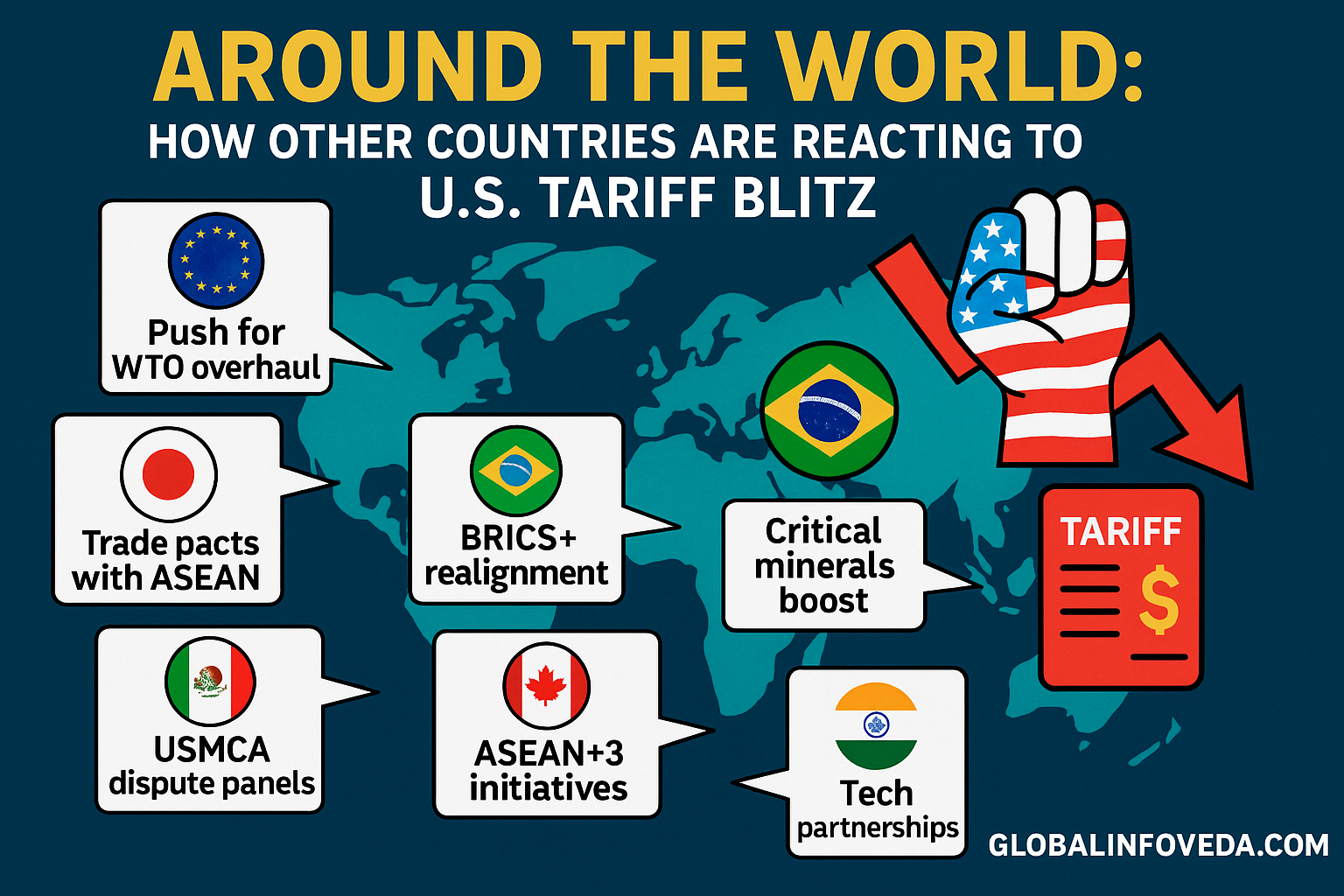

Global Reactions Around the World: Whenever American tariffs jump, tremors pulse through global supply chains, commodity routes and currency desks within hours. The 2025 tariff blitz is much the same — but the global response is more nuanced than a back-and-forth tit‑for‑tat. Governments are balancing retaliation against de‑risking, trade diversion against domestic subsidies, and WTO litigation against minilateral pacts. In the background, procurement teams are redrawing vendor trees and ports are re‑sequencing which inspections to prioritize and central banks are wondering if those import duties are going to mean more persistent inflation. The following explainer charts how the key geographies – EU, China, India, ASEAN, Japan–Korea, Mexico–Canada, UK, Brazil/LatAm, GCC, and Africa – are reacting to the U.S. tariff blitz, why their responses vary, what it all means for consumers and investors and where the second‑order effects may come as a surprise to all.

Meta description: How nations react to the 2025 U.S. tariff blitz—from retaliation to re‑shoring, WTO cases to minilateral deals—and what this means for global trade.

🧭 How a tariff shock propagates through the world economy

A fresh wave of U.S. tariffs triggers an adjustment frenzy that goes well beyond headline HS‑codes. Importers race to front‑load shipments before steeper duties bite, while port congestion and warehousing are stretched. Exporters renegotiate contracts that include duty‑sharing provisions and tighter force majeure language to account for policy swings. Currencies in trade‑exposed economies lurch as forward books clear higher import prices and central banks weigh pass‑through into their core prices. The WTO track commences — slow, legalistic, and pregnant with the right to retaliate — even as faster bilateral deal‑making gets under way on carve‑outs and TRQs. In the meantime, corporate planners are running scenarios such as China+1 and NA+1, splitting BOMs (Bill of Materials) across new hubs. It is not just tariff rates that are decisive in this world, but how quickly the countries that are affected still can re‑route, re‑certify, and re‑price without breaking retail pegs or losing shelf space. Nations with nimble standards bodies, trusted rules of origin systems and good ports turn policy stress into market share.

🧮 🌐 Quick global map—who’s likely to do what, and when

| 🏳️ Region | 🎯 Likely policy response | ⏱️ Time horizon |

|---|---|---|

| EU | Targeted retaliation, WTO cases, green‑industry support | 0–12 months for cases; subsidies phased 1–3 years |

| China | Counter‑tariffs, export controls, re‑routing via partners | Immediate tactical moves; 12–24 months for deep supply redesign |

| India | Mix of diplomacy, selective rebalancing, ASEAN/EU corridor push | 0–6 months policy shifts; 1–2 years corridor gains |

| ASEAN | Trade diversion capture, ROO tightening, investment promotion | 0–12 months investment wins |

| Japan–Korea | Standards cooperation with U.S./EU, critical tech friend‑shoring | 0–18 months |

| Mexico–Canada | USMCA leverage, near‑shoring bids, origin enforcement | 0–12 months |

| UK | Targeted bargains, services‑heavy hedges, digital trade push | 0–12 months |

| Brazil/LatAm | Commodity hedges, selective import tax tuning, Mercosur outreach | 0–12 months |

| GCC | Energy‑linked diplomacy, logistics corridor expansion | 0–18 months |

| Africa | AfCFTA acceleration, standards harmonization for diversion | 6–24 months |

🇪🇺 Europe’s calculus: defend industry without igniting a price spiral

Europe’s response to the U.S. tariff blitz is gripped by two competing objectives: protecting manufacturing while preventing yet another inflation flare‑up. Expect a layered approach. For one thing, WTO consultations and disputes create legal precedents, even if panels are slow to rule. Second, Brussels uses countermeasures with metered effect, often mirroring political symbolism (motorbikes, whiskey) and strategic leverage (industrial inputs). Third, the EU redoubles its Net‑zero Industry ambitions, investing in batteries, heat pumps, semiconductors and green steel, to lower that future exposure. The unsung piece is standards diplomacy: by tightening eco‑design, recyclability and traceability rules, the EU can leverage access to markets without recourse to classic tariffs. For firms, the smart play is not game theory but compliance speed—companies that pre‑qualify under the impending eco‑rules protect their margins even if headline duties fluctuate.

🐉 China’s playbook: counter, control, and quietly re‑route

Turn the page on the editorial page, and the Chinese government’s direct counter‑tariffs are only opening bid. The more powerful levers are those of export controls on critical inputs (graphite, gallium, rare earths), inspection intensity at ports, and the administrative tools that slow targeted categories without formal bans. Concomitantly, China hastens re‑routing via preferential rule‑of‑origin ASEAN partners, co‑locating the final assembly to change HS‑classification. On the domestic front, industrial policy is focusing on EVs, solar, batteries, and AI hardware, with provincial subsidies keeping firms comfortable amidst the storm. The principal risk is overcapacity: if world demand can’t swallow output, export prices go down and margins shrink?—?even if existing routes diversify. Buyers react by dividing orders between China and China+1, trading price for political friction.

🇮🇳 India’s response: diplomacy first, diversification always

India tries to walk between U.S. tariff warfare with a bit of retaliation preparedness and a dash of diplomatic restraint. At home, the priority is to defend consumer prices, which will require protecting exporters’ shelf space abroad. That entails negotiating HS‑line carve‑outs where consumer incidence is most acute to AEO and e‑CoO to ensuring port speed as well as the protracted effort to promote ASEAN, EU, GCC, and Japan lanes as live alternatives. Policy habit also tends to prefer precision to spectacle — TRQ design, focused RoDTEP tweaks and standards alignment in sectors such as textiles, chemicals and auto components. #8 For Corporates, the play is twin‑spec SKUs (value/premium) that are shielded from retail pegs in new corridors with carton engineering and micro‑layered FX hedges to defend margin.

Counter‑strategy perspective: Retaliation or Diplomacy: What India Can Do Amid Rising U.S. Tariffs

🌏 ASEAN: the agile shock absorber of global trade

ASEAN economies — Vietnam, Thailand, Malaysia, Indonesia — stand to gain from trade diversion as multinationals re‑spread assembly. Governments will strengthen rules‑of‑origin to preserve credibility and deepen local industrial parks that package power, water, customs, and certification on one campus. (Stringent export‑control regimes have made it difficult to ship over the components for such installations.) Investment agencies heavily advertise plug‑and‑play facilities furnished with pre‑approved compliance templates. The constraints are skilled labor and grid reliability; the countries that solve those first gain the most. For brands, JVs with local champions reduce ramp times and grant social license. When the volumes flow — however the labels have to change — that leads to some moderation in price spikes for the consumer.

🗾 Japan and 🇰🇷 Korea: friend‑shoring the frontier tech stack

Japan and Korea will hedge with the U.S. on security‑critical technologies — semiconductors, lithography, advanced materials — while preserving export channels to the rest of Asia. We can look forward to more bilateral frameworks on supply resilience, coordinated input stockpiles and shared standards on chip equipment and battery chemistries. Both countries play from a public‑private playbook: long‑dated credit, tax offsets for strategic fabs and co‑funded R&D. The consumer‑side result is nuanced: the price of frontier hardware might go up but reliability does as well, and that latter is something big buyers prioritize more than marginal price declines.

🇲🇽 Mexico and 🇨🇦 Canada: near‑shoring, but with rules‑of‑origin teeth

The USMCA bloc has a special advantage to harvest from near‑shoring, but that potential is contingent on vigorous ROO enforcement to avoid mere trans‑shipment. Mexico is wooing electronics, auto and appliances with its industrial corridors; Canada is emphasizing clean tech components and critical minerals. Each will push Washington for some predictability, and both will rely on dispute settlement when those efforts fail. The prize is firm order books from North American brands that want to reduce policy risk even if unit costs increase. The risk is that bottlenecks — power, water, border congestion — will emerge should investment outstrip infrastructure.

🇬🇧 United Kingdom: trade diplomacy via services and digital rules

The UK relies on its comparative advantage — services. London will have focused goods deals with digital elements (data flows, source code protections) and mutual recognition of professional qualifications. The idea is to soften the impact of manufacturing exposure by furthering services exports and harmonizing standards across a range of hubs. For UK retailers importing tariff‑hit goods, the savers are private‑label redesigns, carton optimization and supplier diversification in and out of the EU and Commonwealth corridors.

🇧🇷 Brazil and LatAm: commodity buffers and selective shields

Latin America’s first line of defense is commodities. Brazil will also focus on ensuring stable agri and mining exports, adjust import taxes where inflation pressure is more acute and seek Mercosur deals that leave room open in Europe and Asia. Mexico aside, lots of LatAm economies will get in line to woo assembly shifts in electronics and appliances, but scale requires logistics execution and rule clarity. Consumers may experience slower disinflation as imported inputs become more expensive, leading central banks to talk tough even if they would rather not tighten.

🇸🇦 GCC: energy diplomacy plus a logistics super‑hub strategy

For the GCC, energy leverage is combined with an aspiration to be the world’s most predictable logistics corridor. Ports, free‑zones, and air‑cargo hubs will sell certainty — rapid turnaround, risk‑based inspection, bonded warehousing — to absorb trade diversion. Look for more sweeping economic partnership agreements with Asia and Africa, as well as targeted incentives for EV and aerospace assembly. The consumer upside is continued access to imported goods at a time of roiling shipping lanes.

🌍 Africa: AfCFTA momentum and standards harmonization

The African Continental Free Trade Area (AfCFTA) provides the continent with the necessary platform to turn global dislocation into intra‑African trade gains. Top gratuitous ask is harmonisation of standards, followed by digital customs, and realistic rules‑of‑origin that promote shallow transformation, without throwing open the floodgates. Special economic zones attached to ports like Durban, Mombasa, or Lagos can leverage assembly steps in textiles and consumer durables. For households, the fastest relief can come from food and fuel policy discipline — transparent auctions, targeted support — not crude subsidies that wear on the budget.

🧠 What tools governments are actually using right now

- 🛡️ Targeted retaliation on politically salient categories to pressure negotiation without spiking domestic prices.

- ⚖️ WTO consultations and dispute filings to bank future retaliation rights and signal rule‑of‑law credentials.

- 🧰 TRQs and carve‑outs that soften consumer impact while preserving bargaining chips.

- 🧪 Standards‑based measures—eco‑design, recyclability, safety testing—that shift market access via compliance rather than classic tariffs.

- 🏭 Industrial policy: tax credits, concessional finance, and infrastructure that anchor re‑shoring or friend‑shoring.

- 🧾 Documentation tightening: stricter origin proofs, audit frequency, and risk‑based inspection to curb trans‑shipment.

- 🤝 Minilaterals: small‑group pacts around specific supply chains (batteries, semiconductors) to pool risk and fund redundancy.

Macro spillover view: Trump’s Tariffs Trigger Global Market Crash in 2025—How Did We Get Here?

🧮 🧰 Side‑by‑side—policy instruments, users, and trade‑offs

| 🧰 Instrument | 🏳️ Primary users | ⚖️ Upside vs risk |

|---|---|---|

| Counter‑tariffs | EU, China, Brazil | Signaling power; risks escalation and consumer prices |

| Standards rules | EU, Japan, UK | Subtle market steering; compliance costs for SMEs |

| TRQs/carve‑outs | India, GCC, Mexico | Protects consumers; invites lobbying pressure |

🧪 Case study—EU spirits vs U.S. duties: targeted, symbolic, effective

When Europe picks retaliation targets, it blends symbolism with leverage. Whiskey and other spirits are politically salient in the U.S., creating incentives to negotiate while minimizing blowback on EU consumer prices. The lesson is broader: targeted moves that hit district interests in counterpart nations often open doors faster than broad walls. Retailers, meanwhile, adjust with pack‑size changes and limited‑edition strategies to hold price points without degrading value.

🧪 Case study—Vietnam’s dual‑track: compliance speed plus capacity

Vietnam has become shorthand for China+1, but the reality is a dual‑track strategy: race to compliance (origin proofs, labor audits, safety certifications) while carefully pacing capacity additions so power and ports keep up. The result is fewer inspection holds and more predictable delivery schedules. Brands prioritize suppliers who can pass an audit on week one, not week twenty. That credibility allows Vietnam to capture diversion without eroding margins.

🧪 Case study—India’s knitwear shifts: twin‑spec, carton science, and corridor math

In Tiruppur, mid‑size exporters preserved U.S. shelf space while adding EU orders by launching twin‑spec tees (value/premium), re‑engineering cartons to reduce volumetric weight, and booking shared freight to lift container fill. AEO status and e‑CoO documentation cut port dwell. Even as duties rose, first‑pass yield improved, returns dropped, and DSO shortened—evidence that operational discipline can offset policy shocks.

India‑focused resilience lens: Industry Backs India—Economy to Shrug Off Tariff Shock?

🧭 How retailers and brands protect consumers when tariffs rise

- 🧾 Good–Better–Best ladders with honest specs at the entry tier; premium tiers add real features rather than stealth shrink.

- 📦 Carton optimization and vendor consolidation to lift container fill and reduce damage returns.

- 🧪 Rapid re‑certification pipelines so replacement suppliers pass audits quickly.

- 🧭 Transparent pack math on net quantities to preserve trust.

- 🔁 Flexible promo calendars that smooth demand without fake discounts.

- 🧰 Returns hygiene: diagnostics‑first exchange policies reduce waste and keep loyalty intact.

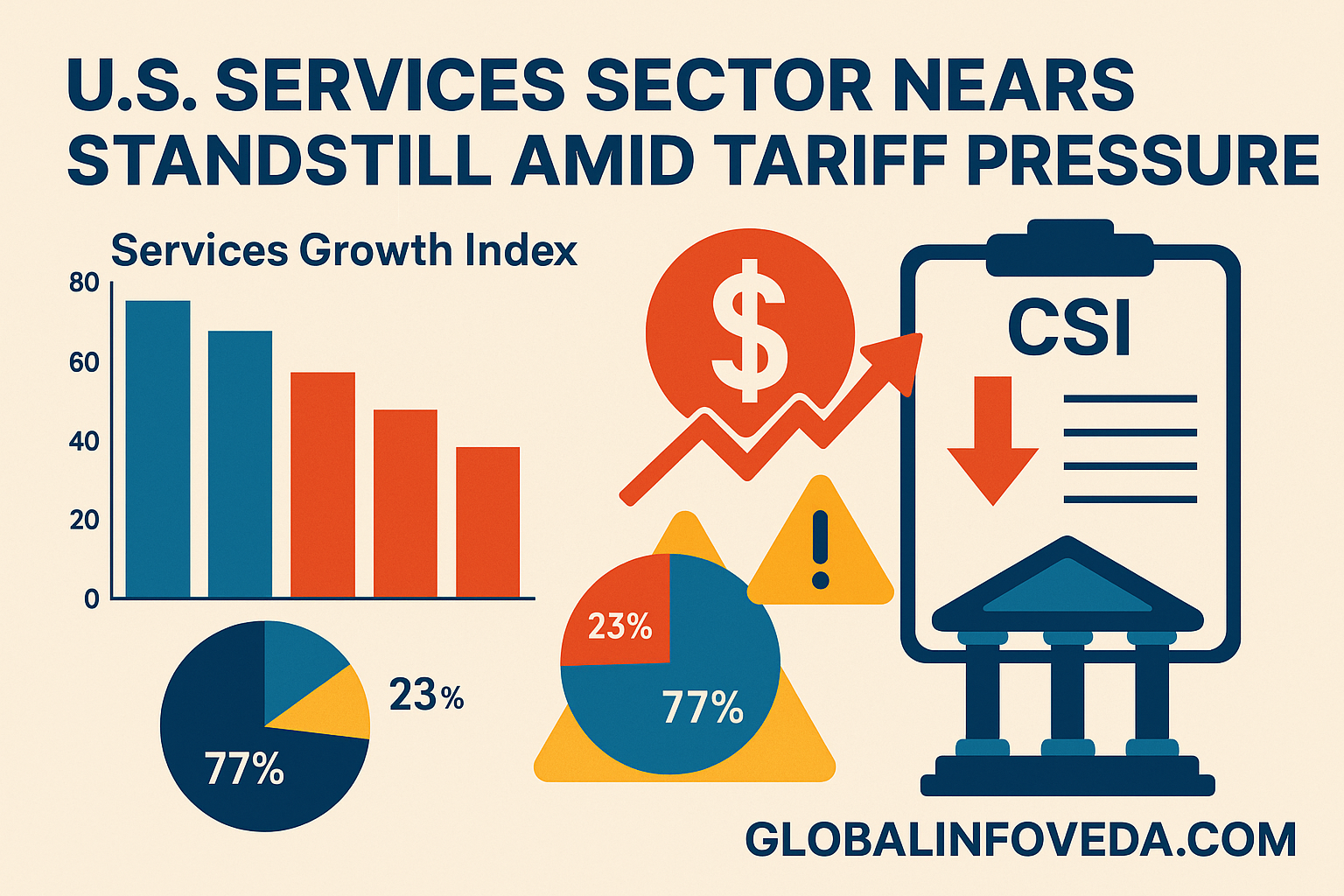

🧠 Central banks’ dilemma: inflation optics vs growth buffers

The monetary authorities have an uncomfortable cocktail: visible headline inflation pressure from imported inputs and cooling external demand. The standard answer is rhetorical — talk tough to set an anchor for expectations while resorting to liquidity tools to avoid tightening into a slowdown. In deep FX reserves can come smoothing operations to soften the spikes; in thin, authorities look to targeted fiscal moves to cushion consumers (fuel taxes, food imports). The risk is second‑round effects around if retailers are able to pass through more widespread price increases. Transparency in transfer in tariffs, and early QUOTAs on sensitive staples, can head off a merry-go-round of panic pricing.

🧮 📊 Investor playbook—how portfolios adapt to tariff volatility

| 💼 Positioning | 🧭 Policy trigger | 🚨 Risk signal to watch |

|---|---|---|

| Re‑shoring beneficiaries | New subsidy credits, export controls | Capex guidance up, margin drag from ramp |

| Trade diversion hubs | ROO tightening, SEZ upgrades | Port dwell time falling, FDI approvals rising |

| Defensive staples & gold | Inflation prints surprise high | Retail pack “shrink” reports, central‑bank tone hawkish |

🧠 What success looks like for governments—and how to measure it

Success is not “winning a trade war”; it’s breaking the cycle of uncertainty for households and companies by repositioning the economy for the next decade. Three measures are relevant: the quality and predictability of ports (dwell times, inspection variance), the credibility of standards (audit pass rates, recall incidence), and the mix of investment (capex share on tradable sectors). Nations that report these measures monthly jam with private investment. Those that don’t will bleed opportunity to neighbors that do.

❓ FAQs

Do WTO cases still matter if panels are slow? Yes. They establish a legal narrative, bank retaliation rights, and shape future negotiating space—even if remedies land late.

Is trade diversion just relabeling? Not if rules‑of‑origin are enforced and supplier development is real. The firms that win invest in quality, compliance, and packaging—not paperwork alone.

Will consumers always pay more? Not necessarily. Smart TRQs, honest pack sizes, and carton engineering can hold pegs; poor policy design makes hikes stick.

Are mini‑lateral pacts a substitute for big agreements? They’re complements—fast to launch around specific supply chains, but they don’t replace broad market access.

🧠 Personal analysis—why reactions differ and who gains in the long run

The U.S. tariff blitz isn’t eliciting the same response from all the nations being targeted. The EU and Japan have regulatory power and standards heft; ASEAN, speed and labor pools; Mexico–Canada, treaty adjacency; India, market scale and services depth; China, capacity and control levers. In the next 24 months, the winners will be those who convert policy stress into process upgrades: speedier audits, cleaner origin systems, better port predictability, and industrial programs that are realistic and that create, not just announce, capacity. Governments and brands are rewarded when they aim for the predicted over the specular, when they invest in quality and pack math over superfluous games of price.

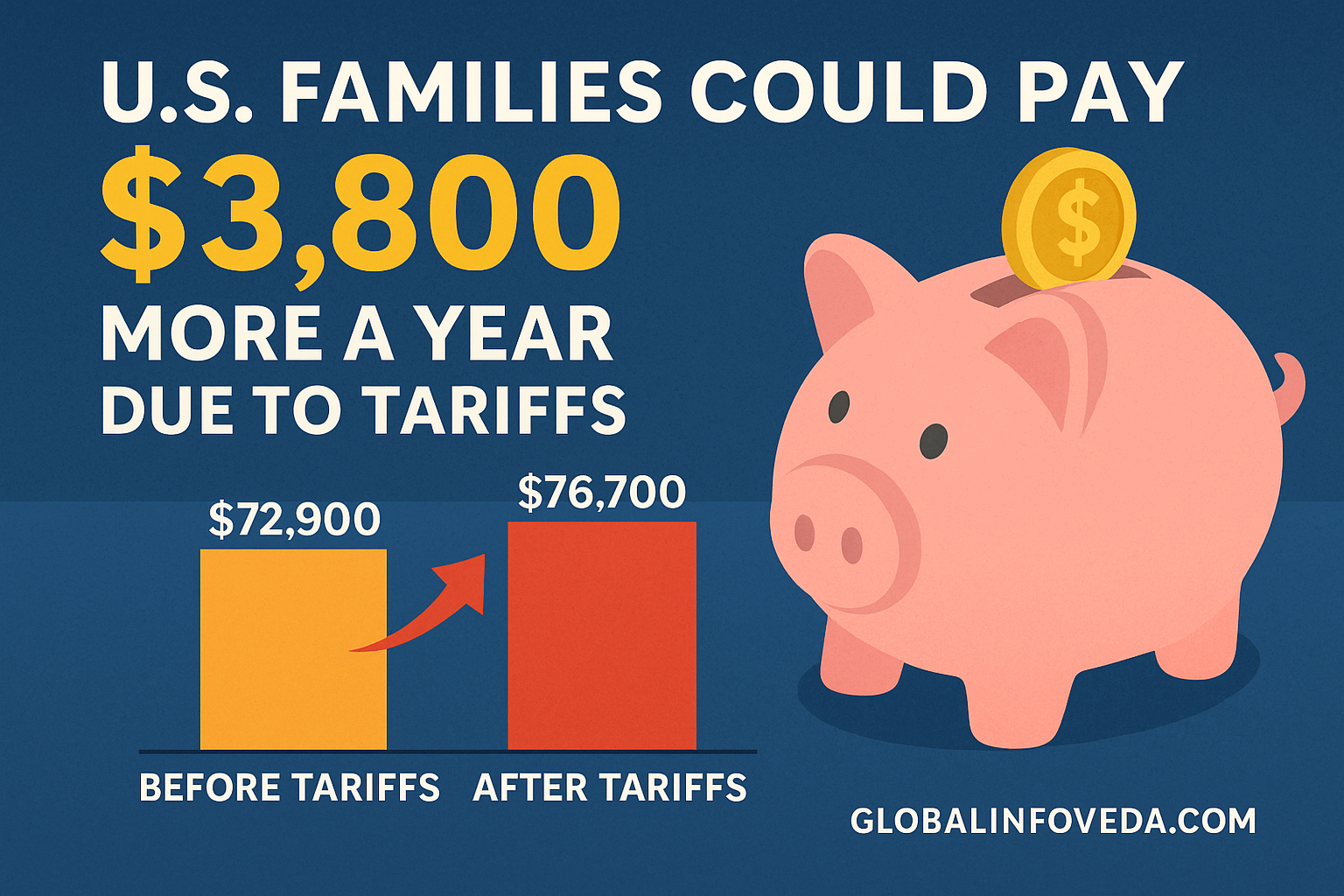

Consumer‑side impact angle: Who Wins? How U.S. Tariffs May Backfire on USA Consumers

🧭 Regional micro‑pivots many analysts miss

Beyond the headline blocs, a web of middle powers and gateway economies is quietly rewriting access to the U.S. market. Their moves matter because they control chokepoints—straits, standards agencies, and free‑zone warehouses—where the U.S. tariff blitz can be softened or amplified.

🕊️ Türkiye and the customs‑union lever

Türkiye’s customs union with the EU allows manufacturers there to piggyback on European rules‑of‑origin and type‑approval regimes. Also to come in the next year: a push to co‑locate finishing steps — that being painting, say, or packing, or firmware flashing — in Anatolian industrial parks so goods clear into Europe and redirect along preferential corridors. The constraint, of energy price swings and local cost of borrowing; the opportunity, of integrating closely with German and Italian supplier networks that prize proximity and speed. For global consumers, that diverting can help to maintain appliances and light engineering products at prices they’re used to, even while headline duties are jiving about.

🛰️ Australia–New Zealand: quality rules as market access

Australia and New Zealand won’t play fire-with-fire on tariffs; they will just up the ante on biosecurity, sustainability and traceability requirements. That sounds technocratic but it is a commercial gate, one that determines which suppliers can get meat, dairy and specialty food on the ground with little or no delay. For electronics and med‑tech, ANZ regulators’ MRAs with Europe and parts of Asia make being compliant a passport. The true tale is reliability: when policy noise rises, retailers pay for certainty on the shelfing, and ANZ can deliver certainty.

⚙️ Eastern Europe’s battery corridor

From Poland to Hungary, a battery and e‑mobility corridor is forming with strong links to Korean and Japanese firms. If U.S. duties tilt EV math, these plants become optionality hubs for friend‑shoring into Europe and, indirectly, North America via standards alignment. The KPI to watch is gigafactory ramp yield; when yield stabilizes, costs fall even as tariffs rise, protecting end‑customer pricing on premium segments.

🌾 North & East Africa’s agri‑logistics hedge

Morocco, Egypt, Kenya, and Ethiopia are scaling packhouses, cold chains, and air‑freight vegetables and flowers. When import bills jump in developed markets, supermarkets rebalance to suppliers who can guarantee cold‑chain integrity and audit‑ready documentation. That protects consumers from sudden price spikes on perishables. For exporters, the trick is carton science—lighter liners, stronger corners—that lifts container fill without bruising produce.

🧪 Three additional case stories with operator‑level texture

🧰 Mexico’s appliance triangle—Monterrey, Reynosa, Juárez

Appliance giants targeted by the U.S. tariff blitz didn’t just cross the border and move on. They constructed a triangle: Monterrey for compressors and sheet metal; Reynosa for PCB assembly and testing; and Juárez for final integration and pack‑out. Power contracts were hedged out to two years; carton dimensions were matched to those of the North American pallet. DSO declined because North‑American retailers are more willing to accept shorter invoice cycles when logistics risk is reduced. Result: end‑aisle pricing did not budge for entry fridges despite the duty noise.

🔋 Poland’s “Battery Valley”—yield before volume

Polish plants learned that chasing volume before yield is a false economy. They implemented single‑minute exchange of die and standardized work to stabilize first‑pass yield above 92% before opening new lines. That one metric let them absorb cost shocks from imported cathode materials without pushing prices to consumers. Financing costs fell as lenders saw OTIF and warranty claims improve; capex then expanded with lower coupons.

🏝️ Indonesia’s nickel ladder—ore to EV parts

Indonesia paired export restrictions on raw nickel with incentives for refining and precursor materials. The step‑by‑step ladder—ore → matte → sulfate → precursor—kept value capture rising locally. When duties hit downstream EVs, Indonesian facilities offered an alternative supply for battery inputs at stable lead times. The bottleneck is energy mix; the gains are real where smelters lock renewable PPAs.

🧩 Signals that reveal who’s actually winning

- 🔍 Inspection hold ratio at destination ports — falling holds indicate superior compliance muscle.

- 🧾 AEO enrollment counts — rising numbers mean exporters value predictable clearance more than duty arbitrage.

- 📦 Damage returns rate — declining rates signal smarter pack engineering amid route changes.

- ⛴️ Sailing schedule adherence — fewer rollovers suggest priority allocation by carriers to reliable shippers.

- 💳 Trade credit spreads — tightening for certain clusters shows lenders believe the playbook.

- 🏷️ Entry‑tier price pegs — if ₹9,999/₹14,999 pegs hold for devices, brands are absorbing shocks with cost engineering.

- 🧮 Retailer shrink reports — stabilized shrink implies honest net‑quantity strategy instead of stealth downsizing.

🧠 Procurement head’s field guide—moves to execute in 90 days

- 🧭 SKU bifurcation: introduce twin‑spec models per market—value spec preserves pegs, premium spec carries feature costs.

- 📜 Spec discipline: lock a baseline spec map; any material change triggers buyer sign‑off and updated RoO calculations.

- 🧪 Audit‑ready onboarding: pre‑pack supplier documentation (labor, safety, RoHS/REACH) so re‑sourcing clears in one sprint.

- 📦 Carton re‑design: adjust flute, burst strength, and pallet fit to lift container fill by 3–5%.

- 🔄 Milk‑run logistics: cluster pickups to reduce dwell and damage; publish route scorecards weekly.

- 💱 Hedge cadence: align FX windows with dispatch and sailing dates; ladder coverage instead of single big bets.

- 🤝 Co‑op compliance: share test labs with cluster peers; lower per‑unit compliance costs and raise pass rates.

🧑💼 SME survival kit when tariffs swing

- 🧾 Two‑page lender update: order book, DSO, OTIF, returns, hedge coverage—build credibility to keep limits open.

- 🧰 Tooling amortization: renegotiate with buyers to extend tooling life, lowering per‑unit cost amid duty noise.

- 🧪 Quality gates: simple poka‑yoke fixtures and photo standards reduce rework that tariffs make unaffordable.

- 🪪 Documentation hygiene: digitize e‑CoO, packing lists, and inspection photos; fewer disputes and quicker paying cycles.

- 🧭 Market mix: balance two corridors so any one duty spike doesn’t freeze cash flow.

- 📈 Micro‑FDI: invite small equity from anchor buyers; access their compliance stack and planning tools.

🛍️ Household playbook—protecting the wallet during tariff turbulence

- 🧮 Unit math literacy: compare net quantities and unit prices; avoid paying more for cosmetically “new” SKUs.

- 🗓️ Calendar smart: shift big buys to anchored festival windows when brands plan real promos, not panic discounts.

- 🔧 Repair culture: opt for serviceable products with reasonable spares; tariffs make disposable design costly.

- 🧼 Private label: retailers’ house brands often reflect faster supply pivots; quality can be equal at lower prices.

- 🧉 Menu swaps: for food categories with imported inputs, rotate recipes toward local substitutes until prices normalize.

🧭 12‑month scenario path—what could happen next

The next year won’t be linear. Three plausible arcs can coexist across categories and regions, and investors should treat them as a menu, not a forecast.

🚦 Scenario A: Escalation but orderly reroute

U.S. duties expand modestly; partners retaliate symbolically. Trade diversion absorbs shock with ASEAN, Mexico, and Eastern Europe winning orders. Inflation blips but retreats as ports remain predictable. Winners: friend‑shoring hubs, carton makers, audit firms. Risks: overconfidence, under‑investment in energy reliability.

🤝 Scenario B: Partial truce with standards shift

Headline duties freeze; regulators pivot to standards‑based access (eco‑design, recyclability, cybersecurity for IoT). Compliance becomes the tariff. Winners: labs, software bill‑of‑materials providers, packaging innovators. Risks: SME fatigue from audit load; consumer confusion if specs aren’t communicated.

🧊 Scenario C: Fragmentation pockets

Selective export controls and financial sanctions split specific chains (advanced chips, some pharma inputs). Prices rise in niches; broad consumers see stable baskets. Winners: firms with dual‑sourcing and twin‑spec. Risks: sudden shortages from single‑point failures.

🧠 Central‑bank and fiscal choreography—what actually calms prices

Policy that works looks boring: early TRQs on staples to pre‑empt hoarding; transparent fuel tax bands to smooth pump prices; and targeted credit lines for inventory financing so retailers don’t pass panic costs to consumers. Central banks keep rhetoric firm but let liquidity support working capital. The tell is core inflation staying anchored even if tradables wobble.

🧩 Data watchlist—15 live metrics for your dashboard

- ⛴️ Port dwell time and variance

- 🧪 Inspection hold frequency

- 🪪 AEO penetration

- 📦 Container fill rates

- 🧾 DSO/ DPO trends

- 🔁 OTIF delivery

- 🧰 Warranty call rates

- 💵 Trade credit spread moves

- 💱 FX realized vs budget

- 🛒 Entry‑tier price pegs integrity

- 🧮 Retailer shrink reports

- 🏭 Capacity utilization in winning clusters

- 📥 FDI approvals in SEZs/parks

- 🧯 Recall incidence after supplier switches

- 📈 Import share by corridor for tariff‑hit HS lines

🧭 Leadership cadence—meetings that make volatility boring

High‑performing teams run a weekly ops room with the metrics above, a biweekly buyer call to align specs and calendars, and a monthly lender update to keep lines open. Quarterly board check‑ins force honest risk mapping across supply, standards, FX, and credit. The goal isn’t heroics; it’s predictability.

📚 Sources

- World Trade Organization (WTO) — dispute settlement, national security exception notes: https://www.wto.org/

- International Monetary Fund (IMF) — trade elasticity, inflation pass‑through in WEO/analytical chapters: https://www.imf.org/

- World Bank — Global Economic Prospects, logistics performance and trade facilitation: https://www.worldbank.org/

- OECD — trade in value‑added (TiVA), global value chains metrics: https://www.oecd.org/

🌟 Final Insights

The quest for a 2025 U.S. tariff blitz will be less a single event than a stress test for how countries navigate the tensions among retaliation, consumer protection and long‑term competitiveness. Governments that operate with surgical precision — TRQs where incidence is high, standards that reward genuine quality, and ports that run on time — will reduce the bang for households and earn investor confidence. For brands, the new law of the land is to make compliance and packaging profit centers, not costs; for central banks, it is to keep expectations anchored while cushioning credit flows. Over the next two years, the world map won’t diverge so much as re-braid around friend-shoring nodes and dependable corridors. The reward is for systems that transform policy shocks into permanent process gains.

👉 Explore more insights at GlobalInfoVeda.com